Ryan O’Connor and Todd Wenning are real experts on Nintendo. In our follow-up conversation, we have made an update on the stock of this Japanese company.

- Introduction to Ryan O'Connor and Todd Wenning

- Nintendo Before the Switch Release

- What Nintendo has achieved since 2017?

- Active Users

- The Demographics of Nintendo Customers

- Nintendo's Marketing Power

- Lego & Nintendo

- Building Trust

- Return on Investment

- Community Exclusive: Biggest fear of a Nintendo investor

- The Switch Selling Cycle to Existing Customers

- The Developer Ecosystem

- The "Switch Pro"

- Hardware’s Forward and Backward Compatibility

- Nintendo Switch Online

- Monetization possibilities

- Read Ryan's Letter!

- A Hopeful Outlook

- Thank You & Goodbye

Introduction to Ryan O’Connor and Todd Wenning

[00:00:38] Tilman Versch: Hello, subscribers of Good Investing Talks and listeners, it’s great to have you back. Today, we are discussing Nintendo again and I have my 2 superstars of Nintendo here, Ryan and Todd. It’s great to have you here and back on. How are you doing in these crazy times?

[00:00:57] Ryan O’Connor: Good, good, Tilman. It’s great to be back on. I wish it was better circumstances globally. But might as well talk Nintendo, put smiles on people’s faces.

[00:01:14] Todd Wenning: It’s great to be here, thanks. I echo Ryan’s sentiments that this is something that is actually fun to talk about. I’m so happy to do it.

[00:01:26] Tilman Versch: And Ryan already showed some of the papers he’s preparing. I think you’re preparing a big report on Nintendo that will soon come?

[00:01:33] Ryan O’Connor: Yes, it is currently being formatted, and with the charts and everything it’s been a little bit of a process. Hopefully, we will release it in conjunction with the video. It depends on how long you take to turn it around. Hopefully, it will come out right after we’re done.

[00:01:56] Tilman Versch: We will link it for sure here in the show notes so people can find the report and also can read about it and there will also be a transcript on the website. But without further ado, let’s dive in a bit.

Nintendo Before the Switch Release

[00:02:07] Tilman Versch: We already had like a few days ago, the 50 years anniversary of the Nintendo Switch. So if we all go back in time and think about the situation Nintendo was in in 2017. How would you reconstruct the situation of the company and also with, in mind what they have achieved since 2017? But maybe let’s look at the days before the Switch. What kind of business was Nintendo then?

[00:02:35] Ryan O’Connor: Sure, do you want to go first, Todd?

[00:02:39] Todd Wenning: My comments won’t be as thorough as Ryan perhaps, but I think Nintendo at that point was trying to search for the next console. The Wii was a huge success. 3DS and DS were huge successes, but they were still trying to figure out where they belonged in the console space. PlayStation and Xbox took off in another direction and we can talk about that later as one thing I wanted to touch on was just that they’re really not competitors anymore. They’re wishing each other luck when the consoles come out, that’s not what competitors do.

They had to find their own way and I think Switch was just the perfect mix of their handhold expertise and their console expertise and it just has been extremely successful, obviously, with everything that’s come. It has some great software that launched with it, and it’s just been, we all know the story since, but that was the setup that I took, and Wii U didn’t really take off because I think it lacked that console strength that the Switch has and that’s where I’ll leave it. I’m sure Ryan has more to say on that.

[00:03:51] Ryan O’Connor: Yeah, I think you were coming off a long period where Nintendo was bootstrapping each successive console generation, and with each successive generation the size of the installed base at maturity, the exception would be the Wii, was getting smaller and smaller. That, combined with the inherent cyclicality of the console cycle had branded the business as a hit-driven cyclical, which historically it was.

That along with the disastrous release of the Wii U which I think sold 13.4 million units, kickstarted an era of soul searching and reinvention at Nintendo, and I think they have reinvented themselves and are still in the process of doing so in a lot of ways but probably the largest change from, call it 2017. And from pre-2017 they adopted, I’m sure we’ll get into this, we talked about this a lot last time, but I like to call the Apple model, which is an iterative approach to hardware where they continuously release both incremental and major upgrades. Not only the era of cyclical console changeovers is over.

So I think fundamentally as Nintendo started to transform the intrinsic nature of its business with the Switch, you have to—I don’t know if there’s BCAD type of thing here, but I think that when you think about Nintendo and its past and its future, the game changed for lack of a better term.

That’s what has set in forth in motion where we are today. I think it is a fascinating business and probably the most underappreciated and widely misunderstood of all of the great ubiquitous, global family-friendly brands out there, so it’s a very interesting setup.

I think it is a fascinating business and probably the most underappreciated and widely misunderstood of all of the great ubiquitous, global family-friendly brands out there.

Ryan O’Connor

What Nintendo has achieved since 2017?

[00:06:43] Tilman Versch: Then let’s try a short exercise and maybe try to find from both of you three short points what Nintendo has achieved since 2017, since the launch of the Switch, or three highlights that come to your mind.

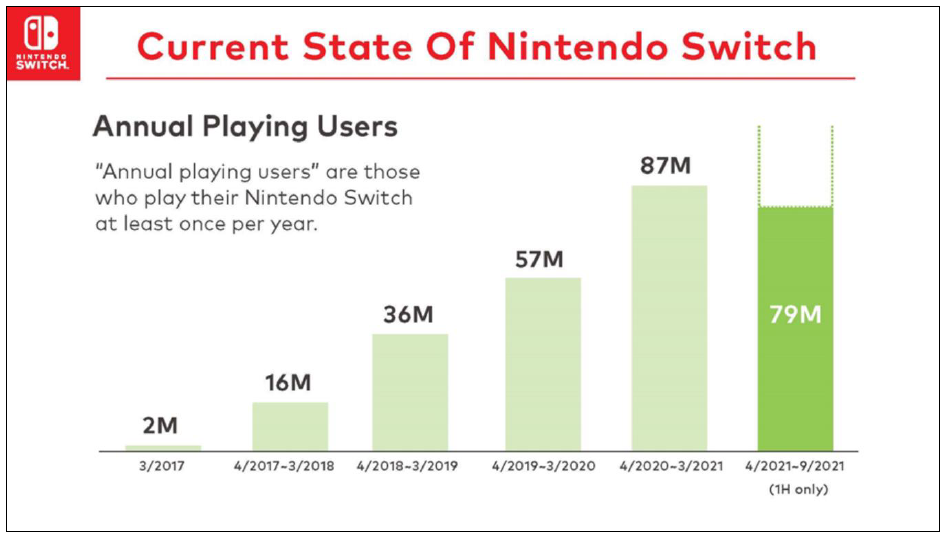

[00:07:00] Todd Wenning: I think the biggest thing to me, the most important thing to our thesis at Ensemble Capital is the digital transformation, the ability to connect directly with consumers for the first time. They have 250 million-plus Nintendo accounts now and I forget the number of Switch, maybe 90 million, and it’s just amazing the connection that they have with customers.

That’s always been the challenge with Nintendo, from a stock investment standpoint, is the cyclicality. When they launch new consoles, they have to re-win all their customers and they have no idea how long Player A is playing this game and Player B is playing that game. Now they know. Now they can create a more sticky relationship with those customers and it’s beginning to become more of a recurring revenue type of purchase than ever before.

So it really slows down. It doesn’t eliminate the cycle, or the cyclical nature of the console, but it does smooth them out quite a bit. That to me is the biggest metric, the biggest change, the biggest thing that they’ve done since they launched the Switch that really gives us confidence that this is not your typical investment cycle.

That’s always been the challenge with Nintendo, from a stock investment standpoint, is the cyclicality. When they launch new consoles, they have to re-win all their customers and they have no idea how long player A is playing this game and player B is playing that game. Now they know. Now they can create a more sticky relationship with those customers and it’s beginning to become more of a recurring revenue type of purchase than ever before.

Todd Wenning

Active Users

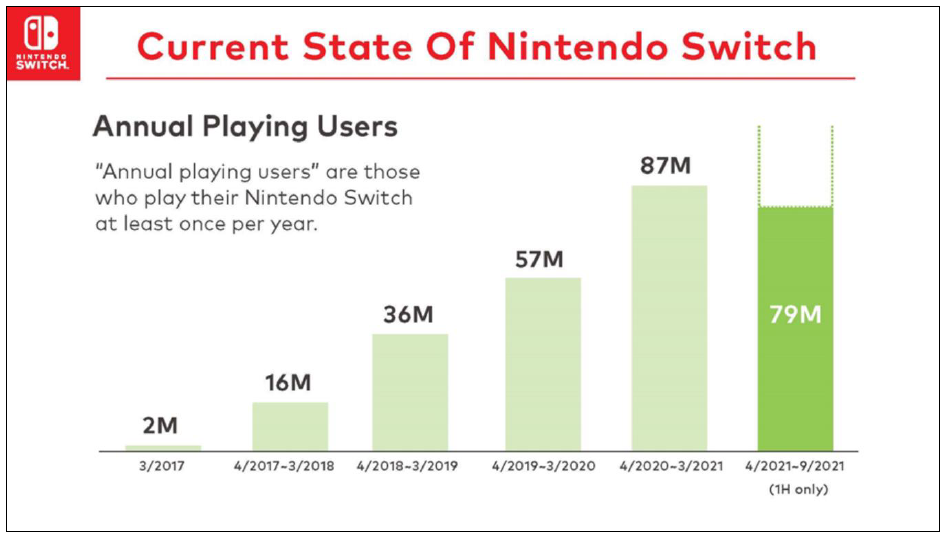

[00:08:25] Tilman Versch: I already have a chart prepared for this and you can see it here. What Nintendo knows about the customers, how many people play it, how many active players they have on the console, and maybe – without losing the train of thought on the three points that Nintendo has achieved -is of the most important metrics you track to track the success of the Switch? This active players or this annual playing users?

[00:08:57] Todd Wenning: For sure. I think that’s the key. What Nintendo doesn’t want, the worst thing it can happen, is that the Switch gets put in a drawer, left to gather dust for months, maybe a year plus, and then people play it once in a while, maybe they forget about it. Those people aren’t going to be primed to spend money on software until there’s a game that they absolutely want to play, and maybe they’ll buy it then and then Nintendo really wants people to subscribe to Switch Online, the expansion pack, which we’ll talk about in short.

That’s what Nintendo wants, it’s more transaction points. They want you to come in and buy things on a regular basis, and again that comes back to smooth the cycle. So that’s all very key to us.

[00:09:42] Ryan O’Connor: Not to completely reiterate exactly what Todd just said, but there are two things that I think are interconnected. I think on the hardware side, going to an iterative model where basically the OS and the hardware evolve and get incrementally better over time in combination with, the digital transformation of the business. Between those two things, you create the hard breaks and the few years of declining revenue and operating profits.

Typically there be one or two years of losses or something equivalent to that I think is gone. One of the things that makes Nintendo so interesting right now, when you look at the macro, not only is it I think a good and improving business, I should say a great business that’s getting better, but at the end of the day, you have internal dynamics that should basically somewhat guarantee that both revenue and margins continue to increase regardless of whether or not money remains cheap or inflation remains high. That is a very unique thing.

This isn’t a business that’s trading at 20 times sales. In fact, if I’m right about the thesis, earnings should continue to grow, revenues continue to go pretty much irrespective of the macro and I know that’s saying a lot right now, but I think that’s unique. I think there’s a limit in terms of the multiple compression that we can likely experience, especially given the contextual backdrop of the space, M&A in the space, what’s going on in Japan, between growth and revenue and margins, expanding operating margins and just the rock-solid, increasingly high-quality nature of the business.

I don’t see how you realistically permanently lose money here over the next three to five years. The multiple is so compressed. Even if things get dicey market-wise, the stock goes much lower, at least for long. In an increasingly uncertain world, I think it is a very unique, very safe, kind of the perfect idea to size up in scary markets in a way where you can sleep at night.

What Nintendo doesn’t want, the worst thing it can happen, is that the Switch gets put in a drawer, left to gather dust for months, maybe a year plus, and then people play it once in a while, maybe they forget about it.

Todd Wenning

The Demographics of Nintendo Customers

[00:12:43] Tilman Versch: It’s an interesting observation I also made the last days. Twitter was quite silent and I’m also like a bit of serving a Nintendo Twitter and Nintendo Twitter was also with this rumor about the Switch Pro, the 5th Anniversary, super loud and super active, and Twitter even fed me content from the Nintendo feed-in which is quite interesting to see how this community is active, how they’ve gathered the community of players that are really eager to play Nintendo and really love their products, which is quite fascinating to see. Also, what customers does Nintendo own? Or to which customers does Nintendo want to have relations? And how sensitive they are to inflation in your eyes?

[00:13:31] Ryan O’Connor: There’s a nuanced answer here. To say that Nintendo is not, for example, susceptible to decreases and consumer spending is a stretch. At the same time, later on, we probably get into like they may be the two to three variables that need to happen for Nintendo to be home run, and in each of these cases, I think you have a very high probability of slam dunk in terms of the dynamics that are propelling, kind of the self-reinforcing feedback loop. I think that’s a really interesting question in itself. Here, let’s stop and revert this. What was the question again?

[00:14:27] Tilman Versch: What customers does Nintendo own, in your eyes? And how they are positioned in this shaky kind of times where you are in?

[00:14:41] Ryan O’Connor: As it relates to the customer. I think that you need to distinguish one of these key variables that I think will determine what the ultimate outcome is with Nintendo is, Nintendo Switch Online. If you look at the history of similar online services, whether you’re looking at their console peers you find that this is a product with inelastic demand and considerable pricing power that if you look at Playstations, historical attach right over time. It is remarkably resilient and defensive.

As the business transforms. I think the core earnings engines of the business are becoming increasingly stable, increasingly resilient, and as software continues to become increasingly a larger and larger percentage of the business, I think one of the primary drivers of Nintendo’s earnings power will be NSO and NSO like PlayStation Plus, and X, Microsoft equivalents, have exhibited remarkable resiliency and should drive the business forward regardless of whether or not consumers are buying less game at the margin because I think they’ll continue to play online.

In fact, they might play online more just because maybe they have less money at home and they’re looking for a cheap form of entertainment. There’s not a much better price to fund ratio relative to other forms of entertainment media than that I think what Nintendo offers. I think that provides us with another layer of protection that is unique.

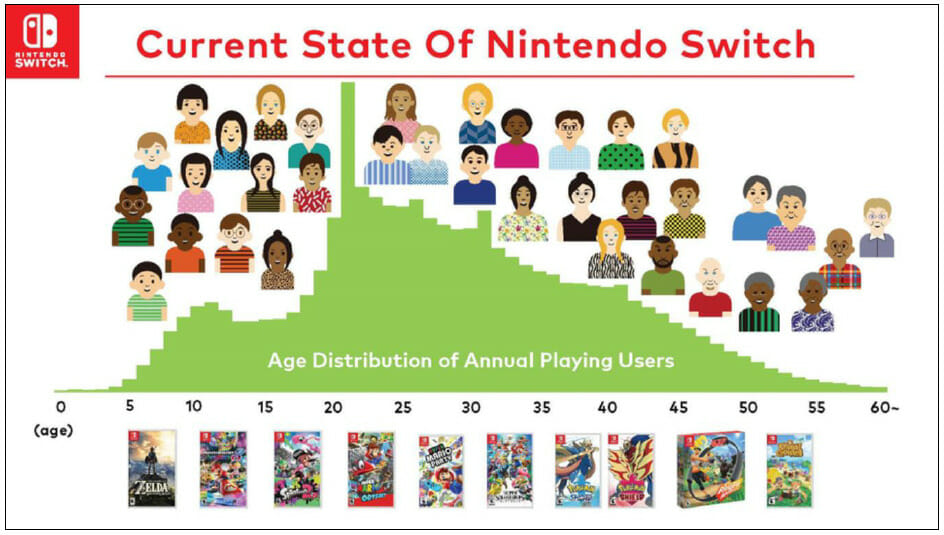

[00:16:41] Todd Wenning: You mentioned earlier what audience Nintendo owns and I recall our previous conversation where you asked for an emoji to represent who Nintendo’s core customer was, and I had a family emoji and Ryan had a whole bunch of different emojis, and I think after Nintendo released that map of who is playing, age-wise, it was pretty clear that Ryan was right the whole time and I was not. I had expected Nintendo’s players to be primarily between 7 and 12 and call it 30–40.

But man, there’s a ton of players in sort of the core gamer age group of like 18–24. It’s interesting that it declines over time and then it drops off after 45. But what’s interesting is perhaps it’s because I’m 40 and I’ve always grown up with Nintendo. That’s where the age group starts and where we see it as a core part of entertainment.

[00:17:50] Ryan O’Connor: It’s the Nintendo generation.

[00:17:50] Todd Wenning: It’s the Nintendo generation. So as our generation gets older will increasingly use it as well so the current distribution that they have on that map will continue to move to the right and I think that’s incredibly exciting because you’re not going to have this age group where people just aren’t playing video games at all, or they aren’t playing Nintendo, they have no emotional connection to the Nintendo IP.

But as we get older, our kids get older, we continue to pass it down from generation to generation just increases the generational interest in Nintendo. I think that’s such a core part of the IP, and I think not to take this off on a different tangent, but I think that’s what you’re seeing with some of the deals happening for, like Activision, for example, there are core video game brands that you just can’t replicate.

You can’t replicate Call of Duty, right? You can’t replicate these different—so you can’t replicate Mario. It was part of 30, 40 years of enjoyment connected to that brand and I think that’s what you’re seeing. That’s why people are going out trying to buy some of this core IP because it’s just so expensive to manufacture from scratch and the payoff probabilities are very low because some games will be a hit, but most games will not and you’re just burning money if you get it wrong.

It’s better to have a sure thing, and it’s why you’re seeing entertainment across the board. Look at the Marvel Universe, that’s what they’re doing there. They’re just going back again, again and again to the well, and people want more because they want to be immersed in that relationship. People, in talking about inflation or whatever it might be pricing power, Nintendo can continue to take advantage of that if they want to.

I think in the console space there are some limitations to how quickly they can raise prices, it’s sort of in people’s heads anchored that $59.99 is the price for a AAA game.

There are a ton of players in sort of the core gamer age group of like 18–24. It’s interesting that it declines over time and then it drops off after 45. But what’s interesting is perhaps it’s because I’m 40 and I’ve always grown up with Nintendo, that’s where the age group starts where we see it as a core part of entertainment. It’s the Nintendo Generation.

Todd Wenning

[00:19:51] Ryan O’Connor: It’s been that way since we were kids, though. It’s crazy. There’s no doubt latent pricing power there. But I mean, if any industry deserves to raise prices maybe we don’t go with what it is, the quadruple A now? I forget which third-party Dev, our publisher wanted to start calling quadruple A to raise the price by $10, $15.

But I do think that that will likely happen in time. Given the increasing cost of games and everything Todd’s talking about. But I think he hits on a really interesting point that I feel doesn’t get the light that it deserves, but we’re part of the Nintendo generation. For the most part, the generations above us looked at video games as entirely a kid’s thing.

As we get older, I call it the passing of the baton. As the Nintendo generation passes the baton to the next generation, the older generations that don’t play video games are dropping off and our kids are picking it up, so you should see a compound. The number of total players that play video games in the world is compounding at a very nice clip and for whatever reason, I don’t feel like that’s ever much of the discussion.

We’ll probably talk about saturation points and things like that later on, but at the end of the day, I think the growth in the video game space is just beginning, and that is a very, very unique and interesting thing. The industry keeps getting better, more resilient, and more stable. Nintendo itself is following that same path.

When we first talked, they were first, second inning. Now they’re midway through, but they still have quite a bit of catching up to do, and as you get the digital transformation, as that works itself through and the industry continues to improve, that creates an outstanding backdrop for thinking about how this opportunity plays out over the next 5 to 10 years. It’s very, very special.

[00:22:28] Todd Wenning: The other thing I’ll just add is, right now, when we’re in our 40s, early 40s, and late 30s, there’s not a lot of time. We don’t have a lot of time to play. At least, I won’t consider myself a gamer. I’d like games, but I’m not a core game. And so, switching, our search costs matter, right? Increasingly as you get older.

I don’t have time to try a bunch of games, different new games. I want to go play a game that I know there will be a threshold of enjoyment. So when I ever knew Mario game comes out. I know exactly that may have this much fun, at least, playing this game, but I’m not going to go spend $60, $70 on games where I may or may not enjoy it.

I mean, not have any connection to it. I have a steep learning curve to get good at it. It’s too much. I think what you’ll see with that chart you held up just before, Tilman, with the age group is that engagement will increase as our generation begins to get more time as we get into early retirement, whatever it is, we have more spare time, and we look for more forms of entertainment.

We’ll turn to games that we grew up with and enjoyed. I think the durability of the Nintendo IPs there’s nothing I’m concerned about there.

[00:23:48] Ryan O’Connor: Only thing I might think about adding is and I think Todd hit the nail on the head when he was talking about Marvel. There are a lot of things that I think make Nintendo’s cash flow extraordinarily stable in a way that isn’t properly understood. You know NSO being a big part but this is becoming more and more the case with time and I think part of it has to do with Evergreen IP.

With Marvel, Disney acquired a company that had boundless source material. Where you had built-in affinity across generations and cross-culturally. It wasn’t—I don’t think as universally beloved, as something like Nintendo, but I think the idea of Todd saying, I don’t want to go learn a new game.

I originally bought the Switch solely to play Zelda. I didn’t play video games for almost 20 years, but I had beaten all of these elders in the past and that was the game that started it all for me. I went out and purchased the Switch solely for that purpose and let’s just say it’s kind of a stretch to call video games high art. But if there is high art that are video games, this is about as close to it as it gets.

It brought me back to when I was ten in a way that was incredibly fun. I know Todd has small kids. Hopefully, I will soon, but this is very much something that not only I think our is the Nintendo generation should they want to be reintroduced to Nintendo games and go back to them is very much primed to pass the things on that they know. In many ways, video games are like cars to our parent’s generation and the freedom of the open road.

There are a lot of parallels but I think one of the things that make our generation unique is we were the first to fall in love with video games and passing that on is not a fad. I think even Munger said something like that or confirmed that in the Dow Jones meeting, which hearing him say, video games are here to stay, was I guess not surprising. I think it’s obvious.

I went out and purchased the Switch solely for that purpose and let’s just say it’s kind of a stretch to call video games high art. But if there is high art that is video games, this is about as close to it as it gets.

Ryan O’Connor

[00:26:31] Todd Wenning: Well, the one analogy I like to use is just a sports franchise, whether it’s like an American football team or Manchester United or whatever it might be. It’s a way to connect generations, right? Like my son and I will always be able to share Mario, he had a Mario birthday party. By the way, I’m not pushing this on him, this is not something where I’m like, you have to play Mario. He’s doing it on his own and then we’re saying, hey, we start connecting that way and so it will all continue.

That’s what Nintendo has to make sure it does, is it continues to delight generation after generation the way that a football team or something like that might do. In that way, it continues to build that brand, that generational connection, which is a hard thing to do. It’s hard for grandparents and grandchildren to connect on lots of things because of their age and their experiences. But they can always go back and talk about with the Cincinnati Reds or whatever sports team they’re talking about because they have that shared experience.

Those are rare things, so I think it’s such a key part of not just intergenerational communications, but global communications, just things that people can relate to and share without having any sort of background that’s similar. We can always talk about Mario, or Zelda, or whatever it might be.

[00:27:52] Ryan O’Connor: Well, and this is another thing that I think is in terms of we want to break the buckets, Nintendo in a bucket things that I think are dramatically underappreciated despite consistent execution and where things are staring you in the face.

I think people are dramatically underestimating Nintendo’s progress in terms of better monetizing its underlying IP and particularly in visual content. As far as the entertainment flywheel, I can’t think of a more powerful feedback loop, frankly. Then these big blockbuster partnerships with Illumination bridge along with those shared experiences that you have.

But it’s just another way to introduce, your kids and to get Mario out there. One of the biggest risks and I think they’re doing an outstanding job is not connecting with the next generation. I don’t think that’s reasonably likely whatsoever, but the impact of movies too, I think is going to be quite a bit. The market is clearly discounting nothing in there.

I don’t know if you guys, I should have actually printed this out, but if you go into, I think it was the annual—last year was the Proxy filing, but in it they were Chris Meledandri, the CEO of Illumination, which I should say up-front, I’ve never seen a more majestic reoccurring box office money machine than Illumination.

Have you guys looked at their history — I mean, it’s bonkers. Each movie’s cost is between 67 million and 76 million and I think their average box office return is something like 640 million. If marketing and production or one-to-one, everything they’ve ever done on average has done 5X. So as Nintendo is their partner, at least in the animation space just now it’s a thing to behold. It’s beautiful in terms of the economics of these movies.

But if the average Illumination movie does 640 million, what do you think Mario is going to do with Chris Pratt and all of that stuff? So people get focused on one thing with Nintendo and they don’t follow along or really pay attention to the evolution of the ultimate impact here and this is what I was getting to in the proxy when they talk about appointing Meledandri to the board.

There’s a little footnote in there that talks about that say give you an idea of what at least the front end in terms of box office is going to be and I think it’s 2% of 2020 full-year revenue. That’s 280 million upfront. If you use that as a general proxy for what Nintendo earn on the front end and then as they build up a library they will retain the full global distribution rights to all their IP, all these movies, visual content, TV.

So that will build too into a dual, double engine reoccurring revenue center. I see no reason why they are. I think with the announcement of the investment that they made. I think it was 440 million USD last November. They don’t break down specifically what’s going to be spent where and how, but when you look at the production cost of an Illumination movie, we don’t know the split, we do know that Nintendo has taken production risk here. This isn’t simply a royalty off the top of sales.

But it’s clear, you could run the math a bunch of different ways, but, between what they’ve already expensed with Super Mario and what they have dedicated to investing in visual content in the future, you’re looking at four or five movies. What that tells me and I don’t want to over embellish it, but they clearly have an MCU like vision here where with the amount of money they’re pouring into, I see no reason why they can’t get to at least one movie per year, say, within the next five years.

Not only you’re going to have these big franchises constantly releasing and becoming part of the cultural conversation but the market is discounting these earnings engines to zero and I think they can start doing somewhere within, say, my forecast trade over the next three to five years. I see no reason why they can’t do something in the odds of half a billion to a billion-plus just from movies and TVs.

I think I might have gone off on a little side point there, but it relates to the larger question of shared values and making sure that Mario doesn’t go the way of saying Mickey Mouse. Not to speak badly of Mickey, but he is less relevant now than he was 40–50 years ago.

Nintendo’s Marketing Power

[00:33:45] Tilman Versch: They also have a lot of like…I save them for you. They also have a lot of marketing power and they could partner with other brands to do marketing. These are the Haribo special editions with Super Mario, which might be also something to put the brand in place before the movie comes and get connections to customers. You’re in Omaha or both?

[00:34:07] Ryan O’Connor: Kansas City. Kansas City. About three hours–

[00:34:09] Tilman Versch: No, we have to—at the…

[00:34:11] Ryan O’Connor: Oh yeah, yeah yeah, yeah. Oh yeah.

[00:34:12] Tilman Versch: Then we have a plan. I save them for them.

[00:34:14] Ryan O’Connor: All right, wonderful, wonderful. I’d rather—I need Haribo over peanut brittle any day of the week.

[00:34:22] Tilman Versch: So they have this marketing capability that’s quite strong and other brands are willing to partner with them, even pay Nintendo to get the Nintendo brand in front of people.

[00:34:35] Ryan O’Connor: Yeah, you made these nuts. I mean you hit on the other part. You kind of break into what I was saying about movies and TV, visual content, same similar deal with theme parks. We just talked about merchandise licensing, and they’re doing it in the way that Nintendo does everything which is painfully slow, steady, methodical, but inch by inch it’s getting bigger and stronger.

People act like there are a few articles that I’ve talked about Nintendo wanting to be the next Disney and don’t think Nintendo wants to be the next Disney at all. I think Nintendo is taking pieces of their playbook to improve their competitive position and grow their business.

But I don’t see Nintendo building a huge massive merchandise licensing infrastructure like, say, Disney does or has to run that giant machine. But I think maybe you guys can correct me but I think the last reported number I saw was Disney did something like 56 billion in merchandise licensing. Nintendo is never going to have the infrastructure. It’s never going to get close to that, but can merchandise licensing get to, say 1 to 5 billion a year at maturity I think. I don’t think that’s a stretch. I don’t think that’s aggressive in time. It might happen more slowly than you’d expect, but I think there’s real potential there.

The same goes for theme parks. This is another element of the business that’s getting discounted to zero, and yet I think we have extremely high visibility into—there’s going to be four parks open, say by the end of 2027, and we already have a second park opening in Super Nintendo World in Japan. The Donkey Kong exhibit and they’ve announced that they are planning new areas within the other three parks as well.

Again, we don’t have the specifics of the Comcast contract, but I’ve been able to go back and look at the royalty rate on theme park ticket sales for Harry Potter at the beginning and there are a couple of other ways you can triangulate it. But between those four parks, and if you’re trying to figure out the economics, somewhere between, call it, if each park has 2 lands, 8-9% in terms of royalty on ticket sales given the power of the IP to drive attendance, and I think there’s 40 million, 39-40 million on average that people that attend each of those parks every year, so it’s quite easy between those four parks to get to 300-400 million in recurring revenue.

It’s not talked about a lot, but there’s also Universal Beijing, which I think has 20 million visitors a year. That would be a great way to use Pokémon ’cause I think Pokémon is bigger in China but eventually, if you just assume those five parks are it, we have a very clear line of sight to another half a billion-dollar pure margin royalty stream that’s worse with very high multiple, certainly more than 20 times that is completely ignored, but also I think critical to reinforcing these shared cultural, weaponized nostalgia for lack of a better term.

It’s finally starting to reveal itself of the financials or will all of these things I think will become more meaningful in a material way within call it the next two years and none of that is getting any credit which is interesting.

Lego & Nintendo

We just talked about merchandise licensing, and they’re doing it in the way that Nintendo does everything which is painfully slow, steady, methodical, but inch by inch it’s getting bigger and stronger.

Ryan O’Connor

[00:38:47] Tilman Versch: It’s also quite interesting if you look at the Lego annual report. They also said something about the Mario sets they sold and it was one of the fastest-selling sets they ever released. So it’s also an indication of the power of the brand and the merchandise they have.

[00:39:06] Ryan O’Connor: It’s good, they’re just very, very careful. I think I read Todd, maybe you guys have read this too or maybe it’s just a recollection I’m getting confused with, but I think I read something with the Lego sets that they spent five months going back and forth arguing over Mario’s hair, which is a dedication to protecting their IP, to say the least, but again, they’re slow. I think they’re making the right choices and very methodically building a very powerful kind of supporting pillars to their core business.

[00:39:50] Todd Wenning: I think that’s something that they get criticized for. They are extremely protective of their IP, like in a ridiculous extent sometimes where people will develop things on their own and Nintendo shuts it down and you hear people complaining about it. Like why didn’t you let us do this? We love the IP so much and Nintendo’s defending it like an artist, right?

Artists don’t want people taking their stuff and messing with it and putting it back out there and making money. That’s misunderstood about the Nintendo culture. They do see this very much as a work of art. There is some concern that they pushed too far, and I think that’s one of the reasons that they’ve had trouble maybe expanding into mobile for example, like they want to control or they want to be exactly the way they want.

Maybe not the graphics, but they want to make the monetization exactly the way they want it to be, and it may not fit with what’s popularly accepted as a way to monetize mobile. For example, they don’t want people spending $20,000 on Mario Kart Go. They want people to pay a flat fee or maybe a small fee and play the game and enjoy it.

[00:41:07] Ryan O’Connor: Todd’s being polite, they don’t want to rip kids’ eyes out with Vegas-like casino monetization tactics and this is one of the things that it’s like there are quite a few people on the sell-side that I’ve never really understood in principle. I guess I do at a high-level Nintendo thesis that’s built around the mobile segment. To me, it’s always quite obviously been about the console business and mobile is a free option that I think, believe it or not, will still land deep in the money with time.

But it’s hardly necessary to the core investment thesis, but in continuously shocked when here we are with a brand whose core IP is cartoon characters where you have a 40-year history, call it a deep reservoir of trust with families and through generations. The fact that people don’t see the risk in approaching your customers this way.

It’s not that I have an issue with say Gacha monetization mechanics, I think when they’re marketed the right way, adult, they can be fine and that’s great. But when it comes to Nintendo and you think in, you have a hundred-year business plan and you are concerned about the permanence of your art and you also take that customer relationship with deadly seriousness. I don’t know why. I can understand why people would want more.

What I don’t understand is why people don’t seem to recognize or grant management’s point of view, which is I don’t care how much money we’re leaving on the table. We’re not going to put ourselves, we’re not going to put the company in a position of headlines where a six-year-old or a 10-year-old or 14-year-old kid was using casino-like tactics to pick their pocket. It doesn’t make sense to me and I think that not only does it take me a minute to come around, not only how they’ve dealt with mobile I think teach a lot about what long-term really means.

I think that being patient and waiting for the pitch to come to them is the right move and I think there are various tea leaves here, but you have the recent announcement with JB with Niantic, so you’re going to have multiple games there. Nintendo was the business, the company that invented the exercise video game genre and Peloton has been doing too hot lately. But when you think about things like Ring Fit and what are there, I think there’s a 14 million installed base there.

Connected fitness, through connected devices, i.e., peripherals, is what Nintendo does. They’ve done this JB with Niantic. The first of this future partnership was a giveaway game but Pikmin Bloom is a walking game and there’s an excellent of all the metaverse AR mixed reality type of applications out there today. One, it’s ironic that Nintendo is the only one that has a game on store shelves that people love, you know Mario Kart Live: Home Circuit.

But it’s interesting to me that they have taken a step back really re-evaluated where they wanted to go with mobile in the interim between I think I’m not sure exactly when we did our first one, but they’ve started to use Mobil gas gaming as a service life service as their primary monetization mechanism, because, at least with subscriptions, consumers know what they’re getting.

It’s not like a 6-year-old, spending money and getting word it’s coming up tails each time. But I think all of the applications, the ones that are the most interesting from a commercial perspective are AR, metaverse, mixed reality when it comes to working out, exercise-based gas is what I would call it and we will see.

But I wouldn’t be surprised if all of Nintendo’s Niantic partnerships are basically exercise-based connected ecosystems for lack of a better term. That’s the way in which they go where the nature of the services subscription. You pulled the Gacha stuff out primarily, and I’m sure with Nintendo’s expertise in hardware really no one has done it better from an innovation standpoint. It’s a perfect way to continue to sell peripherals and to meet their larger mission which is getting people out into the world into the community versus Zuckerberg’s dystopian vision of us all sitting in rooms plugged into the matrix.

So I think the death of mobile is greatly exaggerated. That’s the beautiful thing about when you have IP as powerful as Nintendo does, and your brand is ubiquitous like there is because you have unlimited bats. I mean, that’s the other thing, there is no rush like Nintendo. All they have to do is sit on their thumbs, kind of like investors, and wait for an absolute no-brainer to come across their plate and maybe they strike out three times in a row. I mean Pikmin Bloom — I mean, I’m almost certain it wasn’t intended to monetize at any level on purpose.

But how many companies can just whip and whip and whip? But eventually, they’re going to connect, and if you can compile seven data those games over a 5 to 10 year period that becomes a pretty lucrative, very high margin, a very good business. Yeah, I think mobile is probably the least interesting part of the larger story now, but I don’t think it’s not interesting.

Building Trust

[00:48:05] Tilman Versch: It’s also like if you think about the terms CUSMAC acquisition costs on lifetime value. It’s also like a good customer acquisition cost not to do certain forms of businesses because then our parents willing to pay a premium for Nintendo device is not being sure that they don’t get spammed with advertising that is disgusting. Not that the kids just like buy 400 of euros stuff they don’t want to have on the computer or don’t see zombies for the six-year-old that Nintendo has offered this quality and they can really trust them for a lifetime. The lifetime value is increased by this.

[00:48:42] Ryan O’Connor: That’s what it’s all about. There’s a great Nick Sleep quote. Where he talks about, through his experience, the one common trait that unites the best companies with the best management teams. He calls it the ability to avoid locker room talk essentially, to not care what these guys did. Just stay focused on the mission and I think the quote ends, “In the long run, that’s all that matters.” And I think it was in reference to Costco.

I think it’s ironic, but I think one of the things that I find most attractive about Nintendo is one of the things that I think most people hate, which is their refusal under any circumstances to sacrifice their principles for short-term BS. I think it’s a special thing and I don’t think you find companies that are as clear about their mission and as dedicated to maintaining their integrity over the long run but also pushing it forward and doing smart and creative things.

[00:50:00] Todd Wenning: Yeah, I think it’s a tricky balance for Nintendo because on the one hand, having that long term, hundred-year plan, makes a lot of sense from a principle standpoint, but when you think about how fast the entertainment business is developing, they also have to be able to be nimble enough to respond to it, and one of the things that we really liked was that I forget which report it was, but they talked about we’re in the entertainment business like we understand that and historically, we haven’t taken as many risks, but we plan on taking more risks going forward.

That to us was a really good comment and Nintendo management is constantly cryptic, so it’s always hard to be like, yep, that’s what they’re talking about. But to us, it seems that they are intent and that they understand what they have to do to remain relevant, because going back to—I think we talked about this in the first video, but no one on Nintendo wants to be the last generation of leading Nintendo, right? That’s a core part of this so they have the hundred-year plan, but in order to do that, they have to stay relevant.

They can’t not invest and they can’t just ride their historical success, they have to continue to invest. That’s part of the theme parks, that’s part of the movie, and everything kind of loops in. It’s about diving deeper into the content to become more relevant, and that requires them to make changes, take risks, and develop new products that they may not have done in the past. We are more confident than we ever were before about their ability to do that.

[00:51:35] Ryan O’Connor: Yeah, 100%, I think that’s the perfect counterbalancing point and I just add that while I think they’re getting better at it and smarter and finally focused on the right things broadly. I think no one can look back at Nintendo’s history and not see a company that takes big calculated risks.

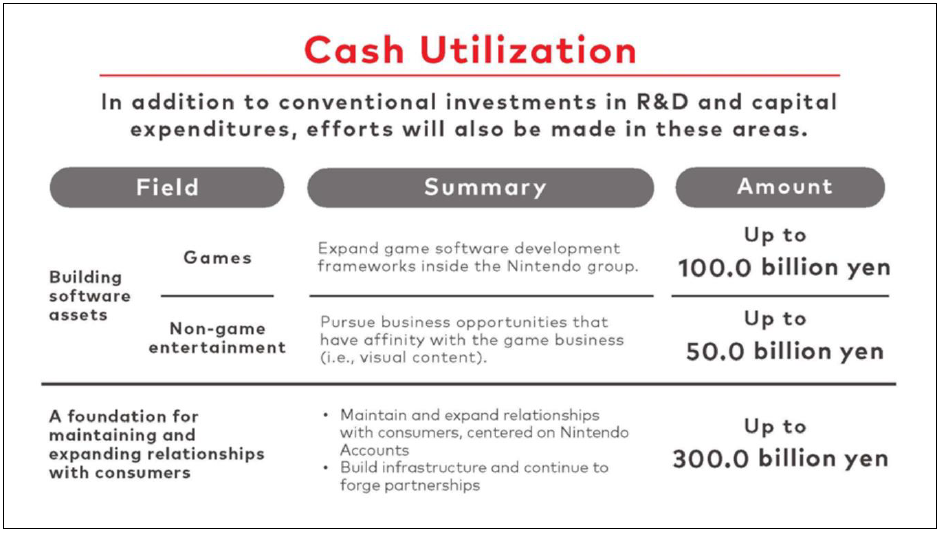

Like, this isn’t a company that sits on there, you ask for lack of a better term. I mean, they’re ambitious, and they’re ambitious as hell, and they’re fearless when they lean into something, which is, I think what was so interesting outside of everything they’re doing for the core console business, putting that much money to work immediately with movies, putting Melisande on the board, all of these things. Here’s an example, and in fact, I think this was interesting, Nintendo suddenly changed their historical reason for their overcapitalized balance sheet.

Historically it was always about maintaining reserves to protect. It was a hedge against failure in the console cycle. Well, now it is…I can’t remember the exact words but the emphasis in the last, I think November was when I remember reading what I want, but they put the emphasis on movies. They said we’re going to lean in hard when it comes to visual content. For this reason, we have to maintain our ability to continually take shots on goal.

Luckily, they’ll be generating so much cash. It’s going to be difficult, I mean, they have a lot of money to reinvest, but movies are something where they can really lean in, get a huge return where it is, genuinely and commonsensical synergistic with the core business in a way that will certainly drive console and software sales. But also and most importantly saying relevant.

It’s not at the end of the day something where they are not oblivious to building and growing the business. It’s just, that I think people want them to focus on what they want them to focus on versus what they are focusing on. I agree with Nintendo, I’d much rather have them focus on building movies that make you cry, and building affinity and deepening their relationship with their fan base this way than squeezing out an extra 20 bucks a month buying more rubies to buy some in-game item in a mobile game.

Reasonable people could disagree, but I think that no one that has objectively analyzed well who Nintendo is as a company, as a culture can say that they don’t take smart calculated risks that they are kind of insular and stuck in the past. I mean, I just don’t think it holds up to scrutiny on any level.

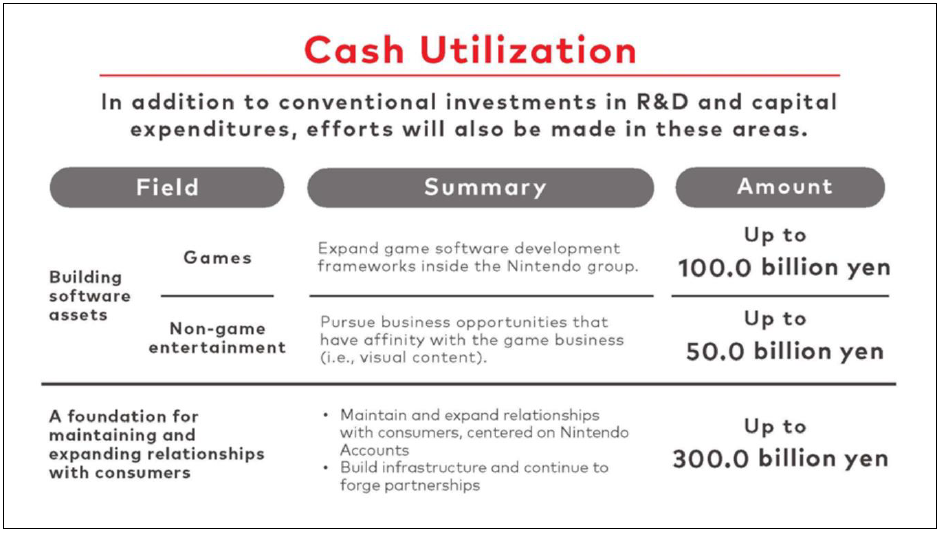

I’m personally excited to see them start making big bets again and in November we saw them take the Bazooka out with roughly 2.7 billion in online network infrastructure expanding their game development frameworks.

I think it’s ironic, but I think one of the things that I find most attractive about Nintendo is one of the things that I think most people hate, which is their refusal under any circumstances to sacrifice their principles for short-term BS.

Ryan O’Connor

[00:55:10] Tilman Versch: I have the chart here.

[00:55:13] Ryan O’Connor: In various ways, I think internally they’re building out their own live service expertise, expanding their software output and the types of software that they create organically, internally. You know, 2.7 billion is a big, big bet, more than enough to fix their technical debt and online infrastructure to build out a server base that is as state of the art as can be to fix online gameplay in a variety of ways.

Every weakness that they had up through November is now concretely being fixed and with more than enough money to do it right, and on top of that, they’re expanding, making another big bet in movies and TV, and putting that cash to work which if I had a dime for every person that’s told me, the cash is just going to build up and they’re never going to reinvest it and they won’t return it or I think we can finally say this question has been settled.

They even bought back a billion dollars of the stock last year. I think when it comes to capital management and reinvesting for growth, the old narrative doesn’t really hold up anymore. That’s exciting to see.

[00:56:47] Todd Wenning: I was just going to say if you looked at the most recent direct, all the Nintendo games that their first-party games, they emphasized the multiplayer. They emphasize the live games and not something that they couldn’t do when they started Switch. I mean they just didn’t have the infrastructure really to do that in a meaningful way that was dependable, but I’ve played a number of times multiplayer with friends across the country and have never experienced some of the technical problems that other people have said.

Not to say we haven’t dropped off, but at times, but I mean that happens with all my technology and so I never felt like it was subpar in any way and I’m sure not about an Xbox player or

PlayStation and maybe that service is better. But again, like I said when we first started this conversation they’re playing different games. What Nintendo is doing and what Xbox and PlayStation are doing are separate, separate things. I know I don’t think you can compare the two.

[00:57:47] Ryan O’Connor: I agree and two dodge points while their online infrastructure, even prior to November before they took out the Bazooka. I think in a big way to make a big statement, a lot of the issues, for example, online play with respect to mobile. A lot of the old first-gen, call it first-gen Switch games, their online gameplay was run off an 18-year-old server system, Next, I think it’s called. And they have basically, I think Monster Hunter Rise was the first game released where that was built from the bottom up with the new system.

But since then and you’ve seen this with Nintendo Switch Online. Nintendo has gone back and patched and fixed every—I think we’re already at the point where for the types of games that are Nintendo’s bread and butter, at least on our first-party level. I mean, it’s ludicrous that we need to talk about a split second. I mean, Mario Kart does not require—you’re not playing Call of Duty, I can understand that, but I think that’s one of the things that’s so exciting about these recent investments is.

I think a lot of this investment isn’t necessarily for their first-party games. I think it is to lay the foundation for third-party games because in many ways bringing free to play games and AAA, multi-platform games from the likes of EA and all of the big developers that haven’t put their stuff on Switch. With the upcoming release of more powerful hardware later this year and these investments, you’re setting the stage to bring all of that to the platform in a way that faithfully recreates that elite level of online gameplay for lack of a better term.

In the end, it’s about bringing the third parties to the yard now and getting all that stuff fixed and in just another way to drive engagement and ensure that no one Switch is sitting in the back gathering dust.

Return on Investment

[01:00:22] Tilman Versch: If we look at these cast utilizations with this chart. That’s quite interesting. Where do you see the return they will get on these investments? What kind of return should this investment have?

[01:00:35] Ryan O’Connor: Monstrous. I think they’re putting in place the infrastructure that is required to press and leverage their position too—people say that Nintendo is not a platform business. My ass is not a platform business. On a gross revenue basis, I think in the November report they talk for the first time ever about third-party games. They account for them on their financial statements, sales from third parties as net revenue, which is a pure 30% margin from the e-shop.

But on a gross basis, which is the apples-to-apples comparison you have to make. Now, more games are sold by third-party developers. These aren’t indie titles either. These are major package software because by definition indie titles and various forms of add-on content cells aren’t included in the software metrics.

This is genuinely becoming a platform where more people are playing games that aren’t named, that were created by firms that aren’t named Nintendo. And I think a lot of what they’re doing both on the hardware side is to keep the network effect accelerating. I think the momentum is incredibly strong. And for a bunch of reasons, I think it’s a near certainty that you’re going to see a, not just a flood of new games, but from third parties and the major ones, but also subscription services.

In my letter, I go through all these different clues, but one of them is a job opening for EA where I’ll tell you it’s regard to Madden. But specifically, their EA Play live services subscription. And I don’t think I’ve ever seen Nintendo mentioned on anything EA ever. I think it’s been 10 years since Madden was on another Nintendo system, but their executives have come out on multiple occasions and said there’s just no way the hardware is not powerful enough. We can’t do it.

Strangely enough, surprise, surprise, at least if you believe the original timeline of when the pro or I think we called like, hopefully, the Super Nintendo Switch. But all of a sudden you started having executives like EA’s start talking about how they’re going to bring all their games and how they would prefer to bring their live service games, who in the past had been said, straight up we can’t do it and you can look at something like FIFA and understand why FIFA 2018 is the same as FIFA 2022 with just rosters and names changed.

You can see that even with this game that’s five years old, they were up against the limits of it. Anyhow, the point is, is just with the EA, if you could sign up for a subscription service and get access to it, I think they don’t have battlefields, or called duty, it’s Battlefield, but all the sports annuities like Madden on a Nintendo system.

Five percent of the installed base of the Switch would easily do that and that’s, take 30% right off the top from that subscription service and just there you have something meaningful and then if they’re going to let EA play onto the Switch platform it logically follows that something like Game Pass would be suitable there too.

I just think there are a lot of clues that all point in one very specific direction which is Nintendo does care about third parties and everything they’ve been doing in these last few years is geared toward that. And I think that’s really, really exciting and it’s yet another element to this story that I think is not priced in at all.

If we think of what happens to NSO, for example, if Microsoft doesn’t tie up with them with Game Pass, just like allowing EA Play in, I don’t know why EA would be hiring for the Switch for a live subscription service if third-party subscription services weren’t going to be allowed on the platform. If you believe that, or if you believe that, that’s happening, it makes total sense that Game Pass would come.

If all of a sudden Microsoft can start offering NSO to their installed base, the numbers get pretty insane. This goes back to a video that came out about a year ago. I think it’s called the Stack Event, but it’s one of Microsoft’s internal development conferences where they speak to developers about what they’re doing. And if in the background there was like 2 weeks before this, there was a Phil Spencer live stream and in the background…

That’s where the age group starts and where we see it as a core part of the entertainment.

Todd Wenning

[01:06:03] Tilman Versch: Oh, he dropped. So we lost Ryan for a second. I hope he’s coming back soon, but do you have something to add?

Community Exclusive: Biggest fear of a Nintendo investor

Hey, Tilman here! I’m sure you’re curious about the answer to this question. But this answer is exclusive to the members of my community, Good Investing Plus.

Good Investing Plus is a place where we help each other day by day to get better as investors. If you are an ambitious, long-term-oriented investor that likes to share, please apply for Good Investing Plus. I’m waiting for your application.

The Switch Selling Cycle to Existing Customers

[01:06:52] Tilman Versch: Also if you think about the customer relation they have and these customers they acquired, acquired early. It’s quite fascinating if you look at the last presentation from November. How these customers are willing to upgrade the existing systems? Like, you have these five years of life spans and with the Switch Pro or Super Switch or whatever comes out, you will have never unlocked of this buying cycle. So you have already a customer base of, let’s say, 20–30 million if you offer them a great product, great update to solve some bottlenecks. They are already in touch with you and love your product and willing to upgrade.

[01:07:30] Todd Wenning: Yes, and we saw some of that this past quarter with the OLED launch. If you look at the overall units were down year over year, but if you looked at just the people who bought the regular Switch or the original Switch and you combined the OLED and original Switch sales, it was actually up.

It was light that pulled things down. What I think is happening is that people upgraded, so if they had a light out of necessity during 2020, they’re encoded when there weren’t original Switch available or if they want to buy a second one for the house, maybe now they’re upgrading to OLED, and by the way, OLED is great.

I was skeptical and when I got mine delivered I said this is just a tremendous upgrade in terms of just the design of it. It’s a much better functioning Switch than the original. The screen is bigger, it’s brighter, the colors are more—it’s just a fantastic experience and I was really impressed with the ability to transfer all of my games and status on the cloud. It was pretty seamless. It’s not perfect. It’s not Apple yet, but it’s pretty close in terms of when you upgrade to a new iteration of Switch.

It’s all going to connect together and your games will be there with a couple of clicks. As I said, it’s not as seamless as Apple where you just sign in and everything there, but it’s pretty, it’s pretty close, and it wasn’t a struggle for me at all, especially since most of my stuff was downloaded software versus physical software, but even then your saved data was all there and they didn’t lose anything in the process, so it was very impressive.

And I think for us, there’s been a lot of talks, obviously, in Nintendo circles about Switch Pro and what it will look like. I don’t know that it’s going to be this super jump and Ryan might disagree with me when he comes back, but I think it’s really this more successive iteration of Switch and where it gets a little better.

It’s sort of like iPhone generations where there’s the SE model, there’s the core model, and then there’s the Max model and what happens is when people upgrade, what happens first is the lowest end of that model upgrades right? And I think that’s happening with Switch with people who had light upgrading to OLED.

It’s just a far better experience and we think that’s going to happen again, and Nintendo has to continue to improve its hardware and Ryan touched on that with the third-party developers, they need to make sure that they can plug their games, they can port their games to Switch without losing a lot of customer satisfaction.

Nintendo has to iterate, but as long as they continue to hold this Switch OS that would be, that reduces the risk of customers being having to be re-won or re-brought into the ecosystem makes it so much easier for Nintendo just to continue to generate recurring revenue.

I was really impressed with the ability to transfer all of my games and status on the cloud. It was pretty seamless. It’s not perfect. It’s not Apple yet, but it’s pretty close in terms of when you upgrade to a new iteration of Switch. It’s all going to connect together and your games will be there with a couple of clicks.

Todd Wenning

The Developer Ecosystem

[01:10:29] Tilman Versch: If you think about the ecosystem, you also have to think about the developer ecosystem in time-based building over time and it’s also the other side of the trade. I’ve talked to developers and they said they started to convert their games to Nintendo. They do it once and then they have to routine and they’re able to do it quicker and quicker and that’s quite interesting. We see Ryan is back.

[01:10:51] Ryan O’Connor: I’m back. I’m sorry about that guys.

The “Switch Pro”

[01:10:53] Tilman Versch: I was just making the point on the developer’s ecosystem that Nintendo. There are also some installations in the development departments of certain developers. I talked to the developer of Nintendo and now can easily Switch their games also to the Switch ecosystem. And with the Switch Pro maybe which might be the end of our interview, because we’re running out of time at this point. What bottlenecks do you expect the Switch Pro to solve and what innovations do you expect Switch Pro or Super Switch to solve?

[01:11:32] Ryan O’Connor: A lot. I think in terms of bottlenecks, I think the two biggest and most obvious are the ability to play current-gen hardware and without or playing current-gen software that requires more powerful hardware. So, in terms in terms of how they’re going to go about it, there are a lot of things that I think are key to bringing it all together.

First of all, you need to be able to eliminate this, not all of the cyclicality is Todd was saying, but you need forward and backward compatibility in terms of game software. Then I think one of the, I kind of joke around with my COO, the Switch is like diamonds are forever. It is forever. That doesn’t mean people get caught up in semantics and confusion or whether it’s a pro, whether it’s revision, whether it’s a next-gen, the point is, is that the software both first-party and 3rd is Evergreen across minor, so minor incremental, i.e., revisions improvements like we’ve seen thus far.

What I think will be the first major iterative upgrade since the Switch has been launched, which is what the Pro will be, and if you get into the details of what I think the chipset or the new system of the chip, that will be, in the next call it generation of Switch family devices it is going to be, I think the Orin, the chip is the T239, which is a variant of the 234.

But the point is that changes a lot of things, for example, on forward and backward compatibility, there are a variety of secular dynamics here that are making technologically, at least technically obsolete hardware a non-issue because most of the processing is offloaded onto servers. I mean for example I can play on my original Switch, the New Guardians of the Galaxy game because it’s done in the cloud and you would never know.

I mean, there’s a variety of trends that all abstract away the hardware layer, and you even see this with the, I don’t know if you saw this tab, but when they did the beta for Switch Sports there was a copyright. Like there’s a picture of it, I have it in our report but that shows that Nintendo is now using FSR, which is Fidelity FX Super-resolution. And so one of the things about the Pro is that it’s going to have 4K DLSS 2.0

And because of the immense upgrade, I think the Pro, the chips that are going to be roughly 4 to 8 times more powerful and then one upscaled through DLSS will be essentially equivalent to current-gen hardware. I mean the chip itself is as powerful as a PS4 pro. But through AI, in upscaling technologies with DLS basically, you won’t be able to tell a difference between PS5 games and third-party games played on the Switch Pro.

One of the things that were interesting and specifically as it relates to older hardware was to see this FSR being implemented into Nintendo’s existing first-party gates. But what is FSR? FSR is like DSL 2.0 light in that it extends the life of older hardware. It’s like getting an upgrade without paying for it. It does a lot of the same upscaling issues and frame rates, but it’s hardware agnostic, unlike DLSS, which requires a much more powerful chipset that has tensor cores and things like that but you’re seeing Nintendo.

The other interesting thing about this was Switch Sports was done in the graphics library of AGL, which is the same graphics library for Breath of the Wild, Mario, honestly all these games. So what that means is that basically, they can just flip a switch, and all of a sudden all these older games are running at a perfect 60 frame rate per second. All of the things that people complain about when it comes to the older hardware relative to the new, even the old hardware should be able to run these games relatively, perfectly.

Games that did not work very well like. I don’t know, The Witcher, these big games will get the benefit as if they had more powerful hardware and better software by Nintendo simply flipping on this FSR Switch, but you have the rise of third-party game development engines like epics unreal.

All of these things, the transition to the server-side makes the technical specs of the hardware, or you’re playing increasingly less. Another thing with forward and backward can build compatibility that I hear people talk about where they say that the architecture is different. They need to have a Tegra chipset and now that will create a break between software in terms of what is playable. That’s nonsense.

Nvidia’s core—with Apple you have for the iOS with the Switch OS it’s basically, it was created from the bottom up with Nintendo Nvidia. It’s called NVN, and everything Nvidia does, even in principle, is meant to be forward and backward compatible. I mean, there are a bunch of management quotes that I could pull out here, but there will be no forward and backward compatibility issues. There might be a few games like you saw in the 3DS that are not backward compatible.

Some fragmentation I think as good as you go from minor to major upgrades. But at the end of the day, the OS is already there. One of the Nvidia hacks was reported the other day. I’m sure you guys saw it. In that code, the leak you’ve seen NVN2 and references to DLSS and all this stuff, which is the 17th hard confirmation that the Pro does exist.

And in more, I think interestingly more importantly is there will be no, it’s not like the pros will need to have an Orin chipset and a Tegra chipset to run the old games flawlessly. The Orin chip, the Orin system chip was built literally from the bottom up to seamlessly blend with all of the others—this is kind of, maybe too many nuanced conversations to go into detail. But I don’t think hardware or software will be an issue when it comes to maintaining just like an iterative hardware model makes hardware obsolete because at the end of the day it’s not about the hardware, it’s about the software because the hardware is just going to get incrementally better over time and small revisions and then bigger leaps. like we’ve seen with generations in the past.

I can’t even remember where I was going with this originally. But the Pro, I don’t think you’re going to have any big fragmentation in the game base. All old Switches we’ll be able to play new Switch games that come out or lead a Nintendo first-party IP that’s released in the future and all old games will be able to run flawlessly on the new hardware.

The other interesting thing about this was Switch Sports was done in the graphics library of AGL, which is the same graphics library for Breath of the Wild, Mario, honestly all these games. So what that means is that basically, they can just flip a switch, and all of a sudden all these older games are running at a perfect 60 frame rate per second. All of the things that people complain about when it comes to the older hardware relative to the new, even the old hardware should be able to run these games relatively, perfectly.

Ryan O’Connor

[01:20:19] Tilman Versch: Now Todd had to leave us and now I’m still with Ryan. Bye-bye to Todd, who sadly had to go at this point in time, not dropped out like Ryan before. It’s a tricky thing to record in these times, but then you also have the feeling comparison to Nintendo Switch Online if you sometimes drop, it’s no problem and you continue the game a while later.

Hardware’s Forward and Backward Compatibility

Can you elaborate a bit more on what you’ve found about the forward and backward compatibility? Because it’s very interesting.

[01:20:52] Ryan O’Connor: Let me sum up the forward and backward compatibility issue, or I call it the energy intergenerational hardware thing. Long and short of it is, I should say as the technological gap between older hardware and the newest Switch widens. Older Switches will run new games both natively and online, be the cloud, while newer, more powerful Switches like the Pro will run older games natively and through emulation. Emulation is, think of Zelda, all the classic, vintage retro games.

You’re already seeing this hardware layer extracted away today. You have Guardians of the Galaxy running on the Switch. You have Ubisoft’s Assassin’s Creed. You have Capcom’s Resident Evil. All of these technologically substantial games already run on the cloud, on the Switch today. So that’s I think a preview of what’s to come as far as ideas that hardware won’t be compatible and that developers will have to go back and patch and change their existing games to work on older hardware or newer hardware, none of that’s true.

The Switch OS was built, hand in hand with the video and one of the things that shocks me is because the video is very clear about this throughout their conference calls or whatnot, but the Switch OS is called NVN. That’s the API and it was custom developed with the video specifically for scalability as well as compatibility across form factors and generations.

A few investors, I think, really seem to understand it at the end of the day maybe I’ll send some company materials when we finish this up where they’ve concerned that Jetsons from Maxwell to Pascal to Orin, all of these different hardware architectures are all fully compatible with the Switch OS, just like all Apples are.

The point is is that I don’t think there’ll be any fundamental bottleneck but I do think that this actually, and we haven’t had a time, any real chance to discuss this today, but one of the elements that are different now versus when I first bought the investment was building in some level of planned obsolescence. It’s a big part of the Apple model. I think it’s a big part of what Nintendo is doing now.

There’s flawless compatibility between, call it generations over here two to three years, minor upgrades, but you can’t play—if you have an iPhone 6 and you try and run apps today it’s going to break it up. So there’s some level of planned obsolescence that is at the heart of this. At the end of the day, the pro will definitively show Wall Street.

Let me say it in a different way, if the Pro is released if we are indeed correct about more powerful hardware coming in the back half of this year or early next. If that happens, you have a, what is essentially a next-gen console or change over and you see flawless forward and backward compatibility between this console break.

There’s no argument left with respect to whether the company is cyclical or not. It is insane to argue that the old standard console cycle will still be the foundation—you just can’t make that argument after this point. That doesn’t mean Wall Street will price it in immediately. But there is no plausible basis if you’re intellectually honest at that point for acting like there’s any—the historical cyclicality, that was the Achilles heel of the industry. I think this is the point where that is definitively done and put away forever.

We’ve seen it with Sony. We’re about to see it with Nintendo, and I think that is the point where people are going to start to wake up in mass and reprice the stock.

Let me sum up the forward and backward compatibility issue, or I call it the energy intergenerational hardware thing. Long and short of it is, I should say as the technological gap between older hardware and the newest Switch widens. Older Switches will run new games both natively and online, be the cloud, while newer, more powerful Switches like the Pro will run older games natively and through emulation. Emulation is, think of Zelda, all the classic, vintage retro games.

Ryan O’Connor

Nintendo Switch Online

[01:25:54] Tilman Versch: Maybe let’s talk a bit about the cherry or the cherries on the cake or if you say it in Nintendo language, the Kirby on the car. Nintendo Switch Online, which is also like changing and getting better and where do you see direction there?

[01:26:16] Ryan O’Connor: At the end of the day we could talk about all the different options, all of the different elements and angles of what I think is, one of the more fascinating ideas I’ve ever come across in my career. At the end of the day, it’s really, really simple. I think there are two drivers or earnings engines that will determine the outcome here.

If these two things are correct, it is essentially a certainty that this will be a home run and one of these two variables is Nintendo Switch Online. So why is that? One of the things that they did recently that I think is a genuine game-changer was coming out in bundling the DLC of their two biggest games with the largest and most active player bases into their higher price tier of Nintendo Switch Online.

So historically NSO came with data storage for the cloud. NES and SNES games are kind of a bare-bones feature for a service that even now is still nascent, but then earlier last year, mid last year they came out with the N64 expansion pack and they have bundled, this is the decision to bundle both Animal Crossing DLC and Mario Kart DLC, into the higher-priced $50 tier versus the $20, I think is a game-changer on several levels.

So let’s think through the math here and like a super basic level. I think the installed base for Mario Kart 8 Deluxe is just gotta be through the rearview, 44 million, it’s probably over 45 million right now. But if you assume, let’s call it 20% of that installed base purchase DLC. So if you already have online, upgrading is a no-brainer, and keep in mind this is we’re trying to get the most active most engaged players out of those 44 million.

I think that’s 7.9 of the—but assuming 15–20% of people that play Mario Kart will upgrade to NSO Online, is a huge deal. Right there you’re looking at between that and Animal Crossing and so they released the announcement with the N64 expansion pack that the Animal Crossing DLC would be bundled in for free.

If you assume—let’s call 15–20% of that player base buys the DLC, you don’t have to differentiate between online whether they have the $20. But the point is this, somewhere between 10 and 15 million people very easily you probably upgraded at the margin somewhere between 10 and 15 million new subscribers came into being for NSO at twice the average ARPU.

Through the past up through November, the last time they reported we had 32 million subscribers for NSO. That was approximately 34% attach rate. If you add the likely uplift to memberships at the higher ARPU from bundling these marquee DLC IPs. The players that are most engaged playing the game are the largest games in Nintendo’s library.

It is a reasonable assumption that something on the order of 15–20% do that. If you do that, if you assume both of those, I think it’s like 16 and a half million. Sixteen and a half million times 50. I mean the readers can do the math, but the bottom line is every dollar of revenue from these subscriptions to this higher price tier is pure margin. I think I have the—let me see if I can…

The players that are most engaged playing the game are the largest games in Nintendo’s library.

Ryan O’Connor

[01:30:52] Tilman Versch: 825 million. It should be.

[01:30:59] Ryan O’Connor: Let’s see, I think, I actually…this is part of the letter.

[01:31:03] Tilman Versch: So again, an idea to look into the letter?

[01:31:12] Ryan O’Connor: Where are you?

[01:31:16] Tilman Versch: It’s a long letter for sure.

[01:31:19] Ryan O’Connor: About 90 pages which are slightly obnoxious.

[01:31:24] Tilman Versch: Epic.

[01:31:27] Ryan O’Connor: But I, I think it should definitively answer and go through all of the remaining arguments and systematic detail.

[01:31:40] Tilman Versch: It’s your Super Mario thesis.

[01:31:42] Ryan O’Connor: Yeah, at this point I might as well—it’s like a book but it is definitely worth it. Anyhow, the point is this, I could pull up a calculator, 16 million new NSO subscribers at the margin is upwards. Let’s just do simple math. It’s a billion dollars.

It was doing 600 million before and just like that not only will does bundling these DLCs again of the biggest franchises Nintendo has with the most engaged player basis for free drive a step-change increase in the attach rate. The incremental profitability that falls to the bottom line, if you put a, let’s call it 20 times multiple on that, is that in of itself is worth about the entire enterprise value today.

And that is just reaching parity on an ARPU perspective with the absolute low end of Microsoft and Sony. We’re assuming a $60 ARPU which is as low as it gets, essentially, $50, actually. The more interesting thing is what Nintendo’s demonstrated actions tell us about the future. We know, Breath of the Wild 2 is about to be released. It’s been five years since Mario Odyssey was released.

So that’s in the pipe somewhere. We just had a Gen 9 Pokémon game released on top of Legends Archeus, that’s going to hit this year. I could go on and off, Kirby, Switch Sports is going to drop which was, granted it was included in the Wii package. But Wii Fit and Wii Sports, and their sequels are like four of the top 10 best-selling games of all time.

Nintendo is carpet-bombing their users with the greatest software lineup in the history of what they’ve done, and I am certain to a relevant degree that what we’ve seen them do with Animal Crossing and Mario Kart here is going to be what they’re going to do for.

Imagine the GameCube Tier, the GameCube expansion pass, and along with that GameCube expansion pass, you get free DLC for Breath of the Wild 2, the next Pokémon game, and the next Mario game, or say the next Mario Kart but plus the GameCube games, plus another vintage system like they did with the Genesis.

But the point is by bundling the DLC you not only get a massive increase in memberships at much higher ARPU, use with relative certainty, but because the engagement will grow along with that and their video games is kind of a linear direct relationship between engagement and profit per user. It’s not that hard to see the future.

Look at the established game plan that they’ve been executing against so far, and imagine, let’s just call it, we’ll stick with the N64 or the game queued expansion pass. Just there, if they bundle those three or four DLCs over the next two years. I can get to roughly 52 million. I think, Sony’s right now at 48. But I wouldn’t be surprised if they are at parity with Sony now just from Mario Kart and Animal Crossing, but this is the bottom line.

Do you think that it will be hard for Nintendo as they layer in all these new vintage consoles and retro classic games? All these new life service games like Tetris 99 and Pacman 99. These marquee DLC IPs that are going to sell thirty million a pop, easy, each one of them, where are they going to price it? My guess is right around a hundred. Right beneath where Sony and Microsoft are for their absolute low-end online services.

I’m not talking about Xbox Live or PlayStation Plus, I’m talking about—I think the next iteration here will be the expansion of something more like Game Pass up. If you think that they can get to 52 million memberships, and you think that the ARPU from each, as they build on top of each other will be, pull it a hundred.