Marc Appelhoff is the CEO of Home24 – a leading European e-commerce retailer for the mass markets. In this interview, we discussed the future of this business which is currently heavily shorted.

We have discussed the following topics:

- Check out Interactive Brokers

- Introduction: Who is Marc Appelhoff? Three Reasons to be bullish about the future of Home24

- Home24's NPS score

- Learnings from building 12 years Home24

- Scenario: Putting future growth investment on hold

- The benefits of growth

- Home24 in 10 years

- Creating long-term value

- Competitors

- Starting the sofa buying journey

- The Butlers acquisition

- Brands of the Home24 universe

- LTV/CAC

- How "cheap" is the acquisition of Butlers?

- Marketing channels (Google & Facebook)

- Why copying the Home24 concept won't work

- The Customer experience

- Consumer taste

- Mobly S.A. - The Brazilian subsidiary

- Enhancing the home24 business model beyond furniture retail

- Home24 and delivery

- Current logistical woes

- The return rate

- Sustainability

- Encouraging repeat customers

- Buybacks (Community exclusive)

- Thank you & goodbye

- Disclaimer

Check out Interactive Brokers

[00:00:00] Tilman Versch: This episode of Good Investing Talks is supported by Interactive Brokers. If you’re ever looking for a broker, Interactive Brokers is the place to go, I personally use their service because I think they have a great selection of stocks and markets you can access, they have super fair prices and a great tracking system to track your performance. If you want to try out the offer of Interactive Brokers and support my channel, please click on the link below. There you will be directed to Interactive Brokers and can get an idea of what they offer for you. I really like their tool and it’s a high recommendation by me. And now, enjoy the video.

Introduction: Who is Marc Appelhoff? Three Reasons to be bullish about the future of Home24

[00:00:37] Tilman Versch: It’s great to have you here, Marc. I’m very much looking forward to doing a deep dive interview on Home24. And we had a huge interest in a lot of questions I could gather and I hope I could answer many of them in our conversation. But for the beginning, I have brought you a bit of a, let’s say challenging chart. It’s a chart with the most shorted stocks in Germany, and here with Home24, you are the leader with close to 10% of short positions in the stock. Let’s invert this perception a bit and maybe you can help me find three key reasons why you are bullish on the future of Home24, instead of being short.

[00:01:22] Marc Appelhoff: Yes thanks, Tilman, for having me. Three key reasons why I’m bullish. If we zoom out, then the internet is there to stay. We are already the leader in home and living in our markets. Online penetration is only 15% nowadays. But it will certainly reach 20-30%, like, in the US and in the UK. So, if we just sit back and do nothing else, we will grow from the more than 700 million proforma, including Butlers, to a multi-billion Euro company. And today, I think our equity value is, if we deduct cash, like 150 million.

Two, we have the best team and we have delivered constantly for the last two years since breaking even on an adjusted EBITDA basis end of 2019, we’ve delivered 80% of growth in the last two years at adjusted EBITDA break-even, just as planned. and we are taking massive market share, because the offline market was down by 7%, for example, in the German retail market.

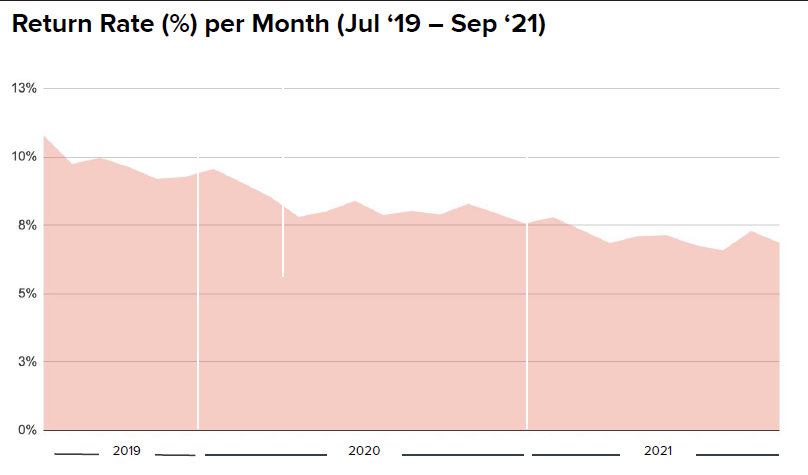

And three, because we offer great value to our customers, which is the most important element if you are a consumer business. And that can be measured both by NPS and also by return rates, where we offer free delivery and free returns and our return rates have reached record lows of only 7% throughout the last year which is a great testimony; that moment of truth, the unpacking of consumers actually works even better over time. Which is something that we had to learn over more than ten years because it’s a very complex home and living customer journey.

We offer great value to our customers, which is the most important element if you are a consumer business.

Home24’s NPS score

[00:03:01] Tilman Versch: What is the NPS score you mentioned you have?

[00:03:05] Marc Appelhoff: The NPS score varies depending on when you measured it. If you compare it to other companies, it’s nearly impossible to do a fair comparison. If we measure NPS directly after the order of the customers, or after the delivery cohorts, it fluctuates by more than 20 points and therefore we don’t publish one NPS data. But what we have shared, I think, in the H2 earnings update last year is that we have improved our NPS ratings by more than 20 points over the last two years gradually working on improving the efficiency of all pain points in the long customer journey of home and living customer.

Learnings from building 12 years Home24

[00:03:50] Tilman Versch: You’ve mentioned you have this, ten years of experience. What have you learned to do right in these ten years?

[00:03:58] Marc Appelhoff: Many things. We also learned from our mistakes, obviously, on the way. When we started to sell home and living products online 12 years ago in 2009, we had no idea that home and living is probably the most complex e-commerce space there is, because

- In the mass market that we tackle, there are no consumer brands. So, there’s a high-risk hurdle you have to overcome if consumers in the mass market spend a lot of money in that perception without knowing you and without knowing the product.

- Home and Living products are bulky and not uniform in packaging. About 130,000 SKUs at the moment, each has different packaging. It’s not like pick and pack in parcel service. And many of them have multi-Kollias, which means a bedroom armoire, a wardrobe comes with 12 Kollias, and if you just lose one or break one, it’s a mess. And you really need to get this process end-to-end from the factory to the customer right, otherwise, you can’t operate that profitably.

- And lastly, it’s a combination of tech play, where we use vast amounts of data of what consumers search for and what they like from our third-party offering, then translate that into our private label offering. And to get the assortment right, to get this stock-taking right is tricky and was a very long learning journey, but we feel we’ve created, also, significant barriers to entry and economies of intelligence and scale there. So, we are very much looking forward to monetizing them also in the coming years.

There’s a high-risk hurdle you have to overcome if consumers in the mass market spend a lot of money on that perception without knowing you and without knowing the product.

Scenario: Putting future growth investment on hold

[00:05:40] Tilman Versch: So let us play a game. We said we make a different future and you decide to stop growing tomorrow or investing into growth and you say okay, in this future, we want to show how profitable our business is at a steady-state if we stop investing into growth. How would Home24 look then?

[00:06:02] Marc Appelhoff: Most of our investments go into assortment and tech. And these teams are also the most important ones. So, next to reducing our marketing ratio from, you know, high teens to mid-single digits, gaining 10 percentage points in profit, we would probably also gain another single-digit percentage points in overhead, which mathematically, plus 1% I think we had in Europe last year or one million in total, if you do 15% on 600 million, I think that would be the starting point from which we would then optimize. And again, we would then still grow with a market rising, the market share. So if online penetration rises from 15 to 20%, even if we don’t invest and just keep our market share, we would still grow.

The benefits of growth

[00:07:00] Tilman Versch: You’ve decided to grow. So, what does growth bring you as a company?

[00:07:04] Marc Appelhoff: We consider ourselves still at the early stages of the industry, in general, for home and living online. There’s not a clear winner yet, like Amazon in electronics or Zalando in fashion, for example. And we believe the long-term value of gaining market share and relevant scale, both for purchasing economies, for economies of the platform in logistics and in tech, will pay back with a very big return in many years to come. And therefore, we rather want to be the leader in our space and therefore, we invest, and when we started the year 2021, we said we want to grow 20 to 40% in highly volatile circumstances. We’ve come out with 27%, on a group level of 29% in Europe, even though the market declined. And therefore, I think that we already see that our strategy of profitably investing in growth pays off because we’ve taken a massive market share.

We already see that our strategy of profitably investing in growth pays off because we’ve taken a massive market share.

Home24 in 10 years

[00:08:13] Tilman Versch: So, then, let’s jump ten years ahead and say Home24 in 2032, how would you look like? And what would the competitive landscape around you look like?

[00:08:26] Marc Appelhoff: Yeah, me personally, I think I would be grayer than today. I mean, we’ve laid out that the proforma group post the acquisition would already today has beyond 700 million of revenue already. Also, for certain profits in 10 years, I would be disappointed if we wouldn’t be somewhere between 3 to 5 billion in revenue at profit margins beyond 10% on an adjusted EBITDA level. The potential in a 110 billion addressable market of the geographies today, not even speaking about further geographies in Southern Europe or Eastern Europe, is definitely there. And I also see ourselves in a very good position to compete over the coming years.

Creating long-term value

[00:09:20] Tilman Versch: What are you optimizing for, for this ten years period out? Many shareholders say, or I heard a critic twice or three times, Home24, your management is only aligned to grow revenues and not grow EBITDA and be focused on profitability. What are you optimizing for?

[00:09:38] Marc Appelhoff: We’re optimizing for long-term market share and therefore, also company value in our view. The Home24 management is not incentivized by revenue. Our bonus is not linked to revenue, and we are incentivized with participation in value creation therefore, our conviction is that we will create long-term value by taking shares and becoming a multi-billion Euro company and not by being a highly profitable small company. And therefore, we focus on continuously taking share.

We acknowledge that especially in Continental Europe, the sentiment at the moment is that profitability is a prerequisite to even investing in small companies. And we are conscious of that and will continue to demonstrate that we have not only that profitable core, but we can also realize profits. At the same time, as long as the opportunity is out there, we want to become one of the winners in our market. We haven’t worked so long and so hard for just remaining a small player; we want to actually be one of the dominating players in our space.

The Home24 management is not incentivized by revenue. Our bonus is not linked to revenue, and we are incentivized with participation in value creation.

Competitors

[00:10:53] Tilman Versch: Which other players do you think will be around, in 5 to 10 years, next to you?

[00:10:58] Marc Appelhoff: In the pure-play online space, Otto already is the largest incumbent, still living off the customers that were used to the catalog and obviously, also making most of their money with a bank attached to the e-commerce business. But they do a decent job and then there are two-three consolidators of the highly fragmented home and living space also in Continental European markets. Most importantly, Hefner and Lutz and there are still so much to consolidate in the highly fragmented offline space, that I’m sure the two at least will also play a role because they operate online shops as well. And in Brazil, it’s Madeira Madeira, who’s a very significant player.

And lastly, as the largest pure-play, Wayfair, who’s only overlapping with us at the moment in Germany, but it looks like they also want to remain trying Europe for longer. They’ve been in Germany since 2009 and they’ve not really made it as successful as Northern Europe and North America, but I also see them as a relevant player in the marketplace space. Just like Amazon, I think there’s no e-commerce play in this world where you should forget to name Amazon, just because they are always relevant for price-focused and convenience-focused e-commerce.

[00:12:33] Tilman Versch: Which kind of category of competition do you think will be less around, or not around at all, in 5 to 10 years?

[00:12:42] Marc Appelhoff: I think especially smaller offline players will continue to disappear as the home and living space is still in early stages if you compare it, for example, with the fashion space. Smaller boutiques and independent players in the fashion space disappeared 15 years ago or so, and then chains emerged, and then online took over next to the chains, the vertically integrated ones. In-home and living, the market is still highly fragmented. The top three players don’t own more than 40% of the market. However, historically, home and living was a very profitable space. These local oligopolies of local furniture stores, connected to central buying groups with good buying conditions, generated massive profits. And therefore, those mostly family-owned businesses have kept on operating, also because often their name is on the big box in the village and everyone knows them. And they’ve got profits buried in property and other topics. So, there needs to be a catalyst for them to actually stop operating. Usually, that is when the next generation doesn’t want to continue the business, and either one of the consolidators takes over or they go out of business.

I also believe that the post-Covid phase will be a catalyst for our industry because we will only see who’s now emerging out of that phase in a lesser state, in a weaker state, once we get out of the pandemic with all the government aids, etc. So, I think 85% of our industry still being offline-prone, and the bottom 20 to 25% of that 85% is the competition we will not see again any more in 5 to 10 years and that will be distributed partly to the consolidators, but obviously, also partly to online and because those businesses will primarily discontinue in remote areas, where no one else will reopen. And those are typically then markets where we, as online players, can play an important role.

Starting the sofa buying journey

[00:15:07] Tilman Versch: That’s a huge shift and I also want to take you now on a huge shift because I want to focus on the customer perspective. And I also want to test if you qualify as my CSO, which is my Chief Sofa Officer, because right behind me, here is my sofa and it’s ten years old and I’m thinking I have to get something new. And now, I’m a customer starting to search for a new sofa, beginning my customer journey, as it would be helpful for an online business to start searching for sofa offers. How do you, as Home24, get ahead of me and like, present an offer of sofas that might be interesting for me as a customer?

[00:15:49] Marc Appelhoff: Yes, Tilman, if you are also one of our “everyday people”, as we call internally, our mass-market audience, then typically, you would not know sofa brands, because the purchase frequency is not that often, brands are known in the higher end, but not in the mass market. And most of our customers then go online and start the search engine and start searching for sofas. Ideally, they qualify that with three-seater, or color, or a sleeping sofa, and then we bid against other competitors for these keywords. Unless you know us from television, we spend up to 20% of our revenues on television. And therefore, we have an aided brand awareness in Germany up to 60%, which is, by far the highest of all pure players.

So, also already nowadays, many people just go directly to Home24, but if you haven’t seen us on television, and you’re probably rather a Netflix than a television guy, then you would probably go to Google and type three-seater sofa, or sofa bed if it’s the guest room and you want to optimize the sofa also with functionality. And nowadays, there is the Google shopping space that is more relevant than the paid text search, and therefore then we optimize to get anyone in the market also on Home24. And looking at the current Google Analytics data, we also are successful in getting pretty much everyone who’s in the market for furniture also on to our page in the time span that they are searching sofas for.

The Butlers acquisition

[00:17:30] Tilman Versch: So maybe then, let’s talk later about your friends, Google and Facebook, and all the big tech. But let’s talk about your new friend. It’s a retail friend, it’s called Butler or Butler’s, you just acquired them. Let’s start with the customer journey we are coming from. What sense does Butler’s make in my customer journey or the general customer journey and maybe also explain what Butler’s is because some viewers are from the US and I think they don’t know Butler’s.

[00:18:00] Marc Appelhoff: Yes. So Butler’s is a factory of ideas. They create more than 3,000 private label accessories and seasonal decoration items and sell them through 130 offline outlets and their own online store and through digital platforms. Twenty-five percent of its revenues are already online and it’s basically a direct-to-consumer brand, for home accessories and impulse purchase items. So, the sofa journey we just spoke about is very technical and difficult because the sofa has a high order value. And it’s only purchased every ten years if you have a decent value for money sofa. For the Butler’s assortment, consumers go there a few times a year to discover something new for their home. And therefore, it’s a huge opportunity to become less dependent on online channels.

For sofas, in most of the Butler’s stores, there won’t be that much space. So, today we already operate Home24 showrooms in ten metropolitan areas. So, you could today already visit a Home24 showroom. We are currently in the process of evaluating the stores of Butler’s and we have identified more than 15 where there is sufficient space to operate a Home24 showroom next to the Butler’s location without paying extra rent, and therefore in more than 15 locations already, in a few months, there will also be sofas and interior decorators to help you if you don’t want to start your journey online. So, you could go there and ask for help. You could bring your floor plan and say, this is my style, you could show pictures and then our interior decorators help you find the right style. And in those showrooms, you can then also sit and have a tactile experience of the fabrics.

I think what always has to be clear is that with more than 100,000 SKUs on offer, the showrooms only always show a small excerpt of what we offer in general, but they give a very good impression of all value-for-money propositions. And even though we offer free delivery and free returns, not only for CO2 purposes, many people actually want to see what they order before they place the order with us. And therefore, we are very convinced that next to being a great assortment addition, next to being a great sales channel, also the combination of coming closer to the customer in a market where 85% of consumer decisions still are taken offline, we will have a much broader access to that offline space and don’t need to wait until all those people also gradually move online.

Next to being a great assortment addition, we will have much broader access to that offline space and don’t need to wait until all those people also gradually move online.

Brands of the Home24 universe

[00:20:53] Tilman Versch: Let me do a bit of a mean follow-up question, like, isn’t Butler diluting your brand, your online business? Now you’re selling, we Germans say, nippers in local stores. How does this make sense? Is it really fitting that much, the Butler acquisition?

[00:21:10] Marc Appelhoff: In the Home24 roof, we already offer many brands. We have third-party brands like Hùlsta or Tempur, as a few non-brands that also do TV or advertising. There are many other brands that exist, but no one knows. And there are also private label brands that we have created at Home24 like Studio Copenhagen, which does similar revenues to Butler’s already today, under the roof of Home24. Butler’s will just be one additional private label brand for those home accessories.

And to just counter your example, why does IKEA discourage online purchases by asking prohibitive delivery prices online and bringing everyone into their stores? Because they make a quarter of their profits with those, as you call nippers, items that you don’t plan to buy and that you still take home with you in that home and living journey. And it is a fact that people love decorating their home for Christmas, for Easter. They love wrapping Christmas presents or presents throughout the year and some of them like to decorate their home because they are a homemaker, they love to make their home nice and hospitable. And therefore, we truly believe it’s a combination that will help both, you know, give more access to the cool Butler’s assortment, all our more than two million active customers will get access to that. But also, tapping into that offer and potential of people that care about their home, and offering those also the Home24 furniture assortment, makes a lot of sense.

And if we also look at the industry endgame for the next years, as you’ve always zoomed out, one of the key reasons that we will succeed is that we need to get CRM and loyalty right. So, we need to convince customers that Home24 is the destination they should visit on a regular basis and not only every ten years, when you need a CSO, a Chief Sofa Officer, and buy a sofa again, because then you might start your journey at Google again. But if you come to Home24 and find accessories on a regular basis, we remain top of mind, we remain in touch, and our app is not deleted. And therefore, we see the impulse purchase and seasonal decoration assortment as a key pillar to achieving this loyalty as well over the coming years.

We see impulse purchases and seasonal decoration assortment as a key pillars to achieving loyalty as well over the coming years.

LTV/CAC

[00:23:40] Tilman Versch: To turn this a bit around and I’m challenging you today, but you’re not really satisfied with your cohorts and their behavior then, if you do this change?

[00:23:50] Marc Appelhoff: We are always looking for ways to optimize our business. And the last time we published our LTV to cohorts was in the IPO process. We published that we were quite happy with the profitability of our lifetime value to customer acquisition cost. It’s roughly 1.5, so for every Euro invested in January, we would have earned a Euro 50 back by December and obviously if we can earn more than Euro 50, by bringing back the customer more often, selling more decoration items and not just the big furniture items; not only selling the table, but selling everything for on top of the table as well, then we are even happier.

Which doesn’t mean that we have reached a quite significant scale and profitability with our core business. So, I think it’s unfair to say we are unhappy with our core business if we add something that makes our business better. But it will definitely be a more profitable LTV to CAC that we see coming out of the combination, if we get our loyalty program right and if we achieve the aim that customers interact with Home24 more frequently.

I think it’s unfair to say we are unhappy with our core business if we add something that makes our business better.

[00:25:14] Tilman Versch: Many investors would love if you start publishing this LTV to CAC and more metrics soon again. When are they coming back?

[00:25:24] Marc Appelhoff: Yeah. It’s always a trade-off of sharing those KPIs because all competition is also looking at that. Especially in a market where we are considered innovators by many, especially bricks-and-mortar companies. Some elements that we do differently are our trade secrets if you want to say so. In a customer journey, we’re evaluated from the first click on our website to the checkout in the basket, valuated for a large item. Please guess, how long valuated is that journey?

[00:26:03] Tilman Versch: Say it, please.

[00:26:04] Marc Appelhoff: It’s two months. So, we pay for Google, and then two months later on average, valuated, the customer converts. Obviously, they buy the small stuff early, but the large stuff takes months or if you furnish an apartment, it takes even many months until you plan and finally decide. Therefore, we have optimized our proprietary marketing knowledge in-house, including attribution models, etc. So, it’s part of what makes us unique. Therefore, sharing cohort data on a too regular basis would dilute that. We are very much aware that repeat ratios and proving that the hypothesis of increasing purchase frequency will improve profitability, also throughout the Butler’s acquisition. But also adding the right assortment will be something we will need to prove to the market not only in financial figures but also in KPI. So, at the right time, we will start publishing the right information without trying to inform our competitors too much.

How “cheap” is the acquisition of Butlers?

[00:27:14] Tilman Versch: I’m awaiting the change in reporting. If we talk about numbers then, let’s do a final part on Butler. Maybe run us a bit through the numbers. How will the acquisition pay back and with a longer time horizon, was it a really cheap acquisition for you if you look out, and what’s your plan there?

[00:27:35] Marc Appelhoff: Yes, let’s start with the acquisition metrics because we’ve also received comments that it’s quite complex and it is. So, three-quarters of the acquisition was done through a mechanism with a fixed purchase price and a variable purchase price that will only be determined with the last 12 months’ profit ending June 2022. And one quarter was done in shares with a Home24 share price of 18 Euro. So, Wilhelm Josten, the founder of Butler’s, accepted for more than half of his shareholding to convert into Home24 shares at 18 Euro. And we said he has to also make that commitment to show that he’s convinced that this is a value-creating long-term addition to the Home24 story and he’s committed to also staying at least for the next four years to make that happen.

For the three quarters that is cash paid, we have structured the deal in a way that there’s an initial purchase price of roundabout 30 million that will be due at closing, and the remainder will be that paid after Q1 of next year depending on their earn-out phase. And both, this year and next year, a portion of the purchase price can be held in vendor loans for a period of three years because two selling shareholders of Butler’s helped us optimize the cash flow.

The Butler’s business today, in 2021 realized 93 million revenue at 5 to 6 million EBITDA. And the stores were closed for up to three months in that year. So, it’s not a full run-rate. Butler’s revenue and profit that we look at 2021. So, I think it’s fair to assume that the revenues will be significantly beyond a hundred million and the profit will also be higher than 5 to 6. And therefore, if we get the economics right, also of the synergy potential, our ambition is that next to the 30 million cash out at closing, there is a good realistic chance that the dealer pays out of cash flow for itself in the coming three years.

Marketing channels (Google & Facebook)

[00:30:05] Tilman Versch: That’s an interesting take. I hope it helps people to understand the Butler acquisition, otherwise, your IR department will help on this, I think. I already mentioned the two big fans, Google and Facebook, but they sometimes can be tricky fans because they know how to raise prices. How dependent are you still on them for customer acquisition and further growth?

[00:30:33] Marc Appelhoff: Yes. So, Google and when you speak of Facebook, it’s primarily Instagram for us, are our important performance marketing partners. In any given month, we spend up to 80% of our marketing spend on performance marketing and 20% roughly, on above-the-line marketing, for example, TV, but also digital out of the home; and not including the showrooms or retail now, in the marketing spend. So I’m only looking at the marketing dollars spent. Google, by far, is our biggest partner, and therefore, yes, we are dependent on being very efficient in Google marketing, but also, we’re not afraid because I also mentioned that it’s one of our core competencies that we have learned over 12 years, how to best do performance marketing.

Many companies that just started performance marketing now, for example in the pandemic, many offline players opened a Google AdWords account and started doing marketing. It’s really an art and science. Is Google constantly looking to optimize its revenue and profits? Yes. Will we always be in a position to outbid competitors if they behave rationally? We are very confident because of:

- the marketing competence I’ve already mentioned.

- the fact that we have a higher contribution margin than marketplaces and by offering third-party items and private label items and therefore, blended higher contribution margins. And at the same time, sufficient selection makes conversion rates work.

I don’t want to overcomplicate things, but let’s go back to your example. If you’re in the market for a sofa, if you type in buy a sofa or gray sofa, ideally, then you have to have a minimum assortment of sofas. Otherwise, the 1 or 2 Euro you pay per click, will be prohibitively expensive. So, if you’re just in Ikea or ikeamate.com, or others who only offer 10-20000 articles and only a certain limited range of sofas, it’s not possible to really bid efficiently on short-tail generic keywords and that’s really where the power of our model comes together. Combining a long tail with the curated short tail and for the short tail, great value for money in short delivery times, because it’s our private label. Therefore, even though the frenemies will continue to raise prices, we feel that it’s a field that we are very well prepared to compete in and will continue to do so.

Why copying the Home24 concept won’t work

[00:33:22] Tilman Versch: Let’s make another experiment. If a competitor is able to rebuild this overnight, compared to the systems you see at your competitors, how many bumps in profitability, in your eyes, this competitor could get?

[00:33:39] Marc Appelhoff: If the competitor could rebuild what we have?

[00:33:44] Tilman Versch: Yeah, your system, your assets in online advertising.

[00:33:51] Marc Appelhoff: Then they would still need the assortment, and the margins, and the 7% return rates which are realized through our fulfillment platform, through our own … delivery. And then, if they get everything right, it’s up to branding at the end, where we still have upside potential. So that would be surprising. But let’s also be realistic that it took us 12 years and we had so many learning economies. We had so many downs, where we had to learn from our mistakes. It’s very difficult to do that overnight, especially with a complex supply chain, the difficult logistics, and also non-branded assortment.

If you would want to replicate that for branded assortment, it would be easier. You go to Zalando and you look at which sneakers or brands they sell, you contact all those brands, and you list those brands. But for Home24, more than 50% of our revenues are private label revenues, and you can’t just find those products anywhere. So, to replicate that would take years of investment. And that’s where we feel we have built also some barriers to entry.

We had so many learning economies. We had so many downs, where we had to learn from our mistakes. It’s very difficult to do that overnight.

The Customer experience

[00:35:12] Tilman Versch: Now I need you again as my CSO, my Chief Sofa Officer. I’ve gone through the rabbit hole and found the Home24 galaxy, and how do you build this place in the online and offline world that I like to stay there? That I don’t get lost as a customer, that you keep focus and, in the end, it transforms in a certain wish or love to buy in your galaxy.

[00:35:41] Marc Appelhoff: Yeah, so there are different consumer types and we look at different personas when we think about the user experience with Home24. For some, it should be an efficient shopping experience. So, it needs to work very well to filter by price, by delivery time, by color. And then they want to look only at a subset and want to make their own opinion. For those, it’s important that we have state-of-the-art web shop capabilities. For many customers in home and living, because the purchase frequency is not that often, they want a consultation, they want inspiration and for those, we offer an inspiration section and a consultation section, where you get 101s basically. It’s like, you can either read them or what we also offer is a free online consultation with a video consultation, you can book an appointment with someone who consults you or you can book an appointment in our showrooms, as you’ve already explained.

So, we really try to be there for the various consumer types and don’t want to tell them how to do their customer journey, but depending on which appetite, very efficient works. If you want a consultation, either offline or through self-education in our inspiration section, or if you need consultation personally, you can call us and we have a so-called pre-sales team within our customer service operations or you book an appointment with some of our interior decorators.

Consumer taste

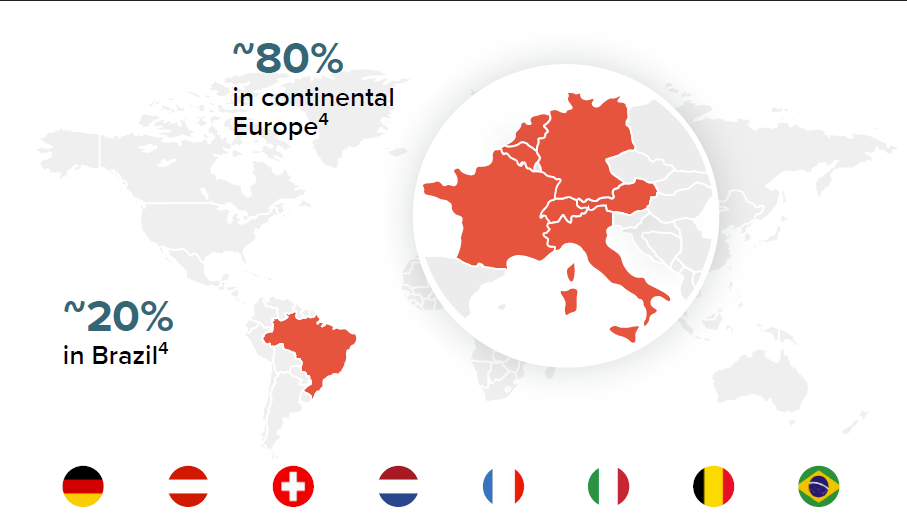

[00:37:25] Tilman Versch: Let us take a look at the Home24 galaxy on a map. I think you know this map very well because I’ve taken it from your presentation. It’s the countries you are active in, and with these countries, my question is related to how you’re fitting the taste of the customers. Like, you have Southern Italy, where you have a very warm climate compared to North Germany, where people have maybe a different taste in furniture, or you also sell in Brazil, where it’s maybe not the best idea. I’m not sure if it works to sell some Nordic furniture into the tropics, like how you’re making sure that you’re fitting the taste of the customer and keep all these complicated regional aspects right?

[00:38:13] Marc Appelhoff: So, consumer tastes globally are quite uniform. It’s surprising with some local differences, but that’s why Ikea is the global market leader selling Scandinavian furniture. At the same time, we don’t have any assortment overlaps or significant assortment overlaps between Europe and Brazil. The Brazilian mass market is much lower in purchasing power. And therefore, the substance of the products is rather on the level of what we, in Europe, would consider a discount, which is not something that you can sell online in Europe because return rates would be prohibitively high.

In Europe, for now, we have primarily focused on the so-called dark area with Home24. We’re very realistic that to win France, Italy, and also to a certain extent Benelux, we need to localize our assortment and in the last year, we’ve started re-initiating our non-dark efforts covered. At the same time, a localization of assortment, for example, bed sizes that differ across Europe, or power plugs is important and it’s something that we are actively working on.

Mobly S.A. – The Brazilian subsidiary

[00:39:36] Tilman Versch: Then, another question on focus. How much energy goes for you into the Brazil business that has a different character as you already explained and if you have so much to do in Europe, is it really worth fighting on the other half of the planet, also, for market share?

[00:39:53] Marc Appelhoff: That’s a very fair question and I think one has to knowledge that Mobly, our daughter company in Brazil, is still managed by the three very independent managing directors. I act as the President of the supervisory board. Philip, our CFO, is also part of the board and then we have two independents. And also, the fact that we IPOed the business in February 2021, is a clear sign of independence and that at the right time, we could also think of fully divesting Mobly, but at IPO, we decided that we want to continue the journey in a very attractive – more than 200 million addressable consumer market and one of the possibly highest growing markets over the next ten years. That’s the situation at the moment.

So, we are sparring partners and I’m having weekly jour-fixes. In fact, just after this call, I will be having my jour-fixe with Victor, the CEO, and it’s time well-invested also because we learn from each other. So, consumer trends or trans consumer experience trends that they experiment with, are then relevant learnings for us in Europe.

[00:41:12] Tilman Versch: So, you’re connecting with your Brazilian daughter through exchanges of ideas. Are you also connected on the business and the IT side? So, is it that you provide services for Brazil from Berlin with your tech teams, or on the advertising side, are you intertwined?

[00:41:32] Marc Appelhoff: The only direct synergy we have in operations is through our sourcing office in Asia. We operate our own import office in Shenzhen with employees that organize the shipping, the quality control, and also supplier audits. We don’t actively exchange code or services from Berlin to Brazil, but we do sparring. So, for example, if one of the mentioned frenemies, Google, also AWS, or some other innovator, launches a new service, then it’s obviously helpful that two companies that are very close to each other and share everything with each other, share learning economies very fast as well. And so, our performance marketing teams are learning from each other, or tech teams are learning from each other. So it’s rather a learning economy, but nothing that could be disconnected should one day we decide to divest.

Two companies that are very close to each other and share everything with each other, share learning economies very fast as well.

Enhancing the home24 business model beyond furniture retail

[00:42:37] Tilman Versch: There’s also another German player and e-commerce space about you. They have this idea of not only being a seller, or e-commerce seller but also a tech company. Is there anything in your business you could think, of in the future, when this model becomes attractive? Or if you think about Amazon and AWS, it’s also a model where other parts of the business became monetized in a different way.

[00:43:01] Marc Appelhoff: For sure, we have relevant solutions for the home and living space that many, especially, offline retailers that are not digitally advanced yet, would like to tap into. For now, we keep that as a competitive advantage and haven’t decided to monetize it yet, but there will be opportunities later down the road in terms of marketing services, possibly also logistics or technology services, and I admire you a lot. And I mean, the fact that they have been born out of the auto context and then serviced many auto companies, led to that servicing sister companies.

So, for us, for now, we focus on our own strategic path, for example, servicing the Butler’s colleagues, and the Butler’s team now with the best solution, and then bringing them to the state-of-the-art level. And that will be a good example, right? Because we brought more than 100 million revenue run rate business and team onto our services, onto our digital solutions, onto our performance marketing solutions. And if that is a big success, we could obviously, at the right time, also offer that to third parties.

[00:44:14] Tilman Versch: Do you already have a rough estimate of what this upgrade of the Butler system will bring you over the long term?

[00:44:24] Marc Appelhoff: I think if we consider systems in general about the digital strategy, we are very confident that we can create significantly more online revenues with the Butler’s assortment, given that Butler’s has never really done performance marketing actively. Their main marketing channel was always the store itself, so our solutions will help broaden customer acquisition opportunities. And yes, we have an idea of our synergy potential, how much that could be and we will measure ourselves against that and at the right time, when we give guidance for this year and then track progress, we will also share that with the market.

Home24 and delivery

[00:45:13] Tilman Versch: Now coming back to my sofa journey, I’m coming closer to a buy decision after being in the Home24 universe, but I don’t want to wait 20 weeks for the sofa and I also want to have a great experience in the delivery. How are you making sure to offer great delivery experiences and great delivery times?

[00:45:37] Marc Appelhoff: Yes. So, in the non-Covid world, that would be easier to answer. How we operate is that we have a forecast algorithm that takes our marketing spend, our historic data, the data of the consumers on the website, and then forecast demand. And I already mentioned that we have a long-tail third-party assortment, where we can’t influence delivery times, just like any marketplace. But for the short-tail private label assortment, we deliberately decide delivery times by stocking, by taking stock, and therefore, on our most popular sofa models, for example, the Hudson three-seater, you would typically have the gray, the anthracite, and the dark blue available from stock, and you can get that delivered very quickly. So, if you order now, within 5 to 7 days in Germany, and we bring already more than 20% of our German two-man handling delivery ourselves with our own services. So own employees, Home24 branded, bring it into your apartment, so it’s a great experience.

For the rest, we work with two manhandling partners, whom we also measure by NPS. That is how we make sure that the end-to-end experience works well for someone who wants it quickly. In covid times, the typical delivery times for made-to-order sofa is usually 5 to 7 weeks, at the moment up to 3-4 months and therefore, consumers are faced with much longer waiting times, across the industry. This is nothing linked to Home24. This is an industry phenomenon.

[00:47:18] Tilman Versch: Even if this delivery time normalizes and you’re still working on this behind-the-scenes on making the delivery experiences better, what can we expect from you over the next five years?

[00:47:35] Marc Appelhoff: We have many ideas for optimizing our services. I think the most important element would be that we increase our service offerings and not just do two-man handling. But with the same teams that are then present in most metropolitan areas, we can offer additional services and we could then at the right time, also be faster. So, should the market truly turn to a position where people say, “I desperately want my sofa same day or next day”, with a regional presence, we could then have local buffer stocks?

For now, I don’t foresee this to happen anytime soon, at least not for large and bulky items that typically are also seeing a longer decision period, because if the customer takes two months to decide, they can count into their purchase decision, the fact that it takes a week to deliver and they just place the order one week earlier. So, getting delivery reliability up is really what drives our business most, because people need to trust us and they come back if they have a very good and reliable experience with us, also on the service side.

Current logistical woes

[00:48:53] Tilman Versch: Another frenemy at the moment of you is logistics and logistic costs. What is your longer-term take on this, will it be a short-term wall? Will the logistics chain settle again? Will you have structural changes? What is your take?

[00:49:11] Marc Appelhoff: Yes, I think short-term, inflation hits, and the markets already see that and we are faced with that like anyone else. So it’s, I think, a situation where scale helps. So, I think we’re glad to be able to digest just that with 700 million of revenues and not 60 or 100 because it would fast eat up our purchasing power. At the same time, we are shifting supply to where we are now, in a new normal. See the best manufacturing location, for example, if container rates have exploded for certain furniture items that can also be procured in other parts of the world, then some of those might shift to Europe.

Typically, the Asian sourcing at the moment is only left to garden, lighting, and office chairs. So, typical Asian procurement and there, eventually markets will return to normal once the extra effects are gone, but it will take time. It will take another 6 to 12 months for that to normalize. And in the meantime, the purchase price and the logistics prices will drive consumer prices.

The return rate

[00:50:33] Tilman Versch: One topic that’s also often discussed with online businesses, is the idea of returning to sender, to ship goods back and you have a nice graphic in your presentation, that shows the return rates that are going down. And honestly, with my sofa I have bought here 10 years ago, I would have loved to return it but it’s something you like as a business owner. So, what is your plan to make these return rates even lower like go, maybe to 5%? And how do you think about the idea of the ability to return goods generally, with your business? Is it something you need to have in this way you offer it or…

[00:51:20] Marc Appelhoff: I think at the moment, it is part of our strength. Because if you have a value for money offer, you also need to put your money where your mouth is, and if you then charge for a return like many of our competitors, if you buy at MADE.com, for example, and you don’t like the sofa, you pay for the return cost. That also signals something to the consumer that he has not the ability to come and visit your showroom or if they would like to return it and then has to pay for it, it’s probably the last time they’ve bought with you.

[00:51:56] Tilman Versch: It’s the same for me. I don’t think I’d buy there again.

[00:51:59] Marc Appelhoff: So, what it really comes down to is saying, if we truly believe we have the best value for money, then the unpacking experience is great. And then we can offer a fair delivery policy with free return as one of the key strengths of the brand. And obviously, as we will add smaller items that are easier to return, our return rate might increase again, but it might not become more expensive because if you send back three pillows, it’s much cheaper than returning a sofa. So what we will definitely continue to do is curate our assortment, both on the third-party assortment, and in the private label segment for value for money and we kick out offenders with high return rates or high claim rates because they cost too much money.

And I think that’s the main difference between the Home24 offering versus a Wayfarer and Otto and Amazon, where more is always better. Because then it’s very difficult or even impossible to control claim rates and return rates. And this is really where we say we want to differentiate by offering the best value for money and therefore, we also need to offer free returns. In the context of sustainability, we might well start charging for delivery costs at least for a little bit, to make people conscious that they’re consuming also CO2 and resources when they order something and can return for free. But I think we will not see the introduction of return charges unless there’s some extra event that we are facing that I couldn’t foresee at the moment.

If we truly believe we have the best value for money, then the unpacking experience is great. And then we can offer a fair delivery policy with free return as one of the key strengths of the brand.

Sustainability

[00:53:44] Tilman Versch: How sustainable are your operations already and how do you want to be better with this? Because there are still a lot of challenges. We have to get more sustainable.

[00:53:54] Marc Appelhoff: Yes, we are at the forefront of the industry. We are already CO2 neutral as an organization, including the entire logistics. So, we’re not just claiming that we will get there, like Otto or others, who launch lobby actions and then speak about it for a long time. In 2019, we have measured our footprint and we have committed to reducing the scope of one and two footprints by 75%. Scope one and two is the easy footprint. It’s locations, warehouses, and commuting of the team. So it’s the directly influenceable footprint. So, this one, we already are actively pursuing. And for the logistics, we are measuring and compensating, but obviously, as we grow, our logistics footprint will grow. So it’s impossible to bring this down to zero, unless there will be solar container ships and trucks also for the very broad supply base, and not just for our last mile.

But having said that, the online customer journey, the online end-to-end fulfillment chain is already much more sustainable than the offline one, whereas offline is often pushed into the central warehouses and pushed to the customers through paper-printed advertising. Our model is rather a pull. We look at demand patterns, we then stock what is in high demand and turns fast, and the rest, we deliver and then manufacture made-to-order and therefore it goes from factory to customer made-to-order without any large warehousing in between. So, we consider our model already quite sustainable and we see our responsibility as human beings and parents as very high, therefore, we have high ambitions to become even more and more sustainable just like other big industry players. For example, Ikea has a very admirable environmental strategy as well. So, I think the industry is heading a good way, at least for the time being.

Encouraging repeat customers

[00:56:08] Tilman Versch: I have to now come back to my sofa journey and congratulate you and thank you, because you helped me also through the information about sustainability to find a nice sofa at Home24, purchase it, and get it in two weeks. But as a customer for you, then I might be gone for a while because if I’m only a sofa buyer, I’m buying the sofa every 10 years, every 15 years. And what incentives are you building to bring me back and bring me and other cohorts of customers back, get you again into buying because that’s important for you as a business to be a good and sustainable business and a profitable business?

[00:56:51] Marc Appelhoff: Yes. I think this is the Achilles heel of home furniture, because if you do a good job, then the purchase frequency is not high because the goods last long. Therefore, it’s about branding, it’s about reputation. And it’s also about staying top of mind. That’s why we don’t only spend in the so-called lower funnel in Google marketing, we also spend in TV and other channels to be one of the key brands in the relevant set. But it’s also why we work on apps and on newsletter marketing and CRM.

And it’s no secret that we have still massive potential to improve our CRM. For example, we don’t have a Home24 club model yet. We take part in payback and other models but together with Butler’s, we will look into introducing a Home24 club model, where you will get benefits to interact with us on a regular basis and benefits to give us your email address or keeping our app on your phone. For example, we could offer Home24 app users a voucher and a discount in Butler stores, because we know that you go there more often because gifts and decorative items are consumed more often than the large furniture items. And it’s definitely something that we will focus on in the coming years.

But also, we think that in the home and living industry, where we have a huge advantage against most of the offline players, because we know our customers. We have their addresses, we have the email addresses very often. And we can remain in touch if we do it right. So if we offer relevant inspiration and relevant curation and not just sales campaigns that are not relevant to you in the short term, then we will be able to leverage this channel much better in the future.

This is the Achilles heel of home furniture, because if you do a good job, then the purchase frequency is not high because the goods last long. Therefore, it’s about branding, reputation, and staying top of mind.

[00:58:47] Tilman Versch: So it sounds a bit like you’re trying to become more of a West Wing in this sense or…

[00:58:54] Marc Appelhoff: We’re not trying to become a shopping club, we’re also not planning to sell everything that the premium market housewife loves on a regular basis. From items that are not relevant for the household, but are rather consumed. What we definitely admire at West Wing is how well they tell stories and the Butler’s acquisition will help us to tell better stories. At the same time, we won’t lose our strengths out of sight and our key strengths in mass-market home and living are to offer great value for money products and do a very efficient e-commerce journey for those as well. And be able to monetize the mass market coming online, which is not something that a shopping club can do on its own.

Our key strengths in mass-market home and living are to offer great value for money products and do a very efficient e-commerce journey for those as well.

Buybacks (Community exclusive)

[00:59:44] Tilman Versch: Let me close with a final question that came from many investors because your share price is down 60-68% from the top. Many investors see you have some cash at hand and ask themselves, why aren’t you buying back shares as a company or sending a signal by buying back shares as management?

Hey, Tilman here. I’m sure you’re curious about the answer to this question. This answer is exclusive to the members of my community Good Investing Plus. Good Investing Plus is a place where we help each other to get better as investors day by day. If you are an ambitious long-term-oriented investor that likes to share, please apply for Good Investing Plus. Just go to good-investing.net/plus. You can also find this link in the show notes. I’m waiting for your application and without further ado, let’s go back to the conversation.

Without further ado, let’s go back to the conversation.

Thank you & goodbye

[01:00:49] Tilman Versch: Thank you very much for this great insight in the way you think about your business and how your business runs. Thank you very much also to the viewers for staying that long and I hope you enjoyed the conversation. I did. Thank you very much, Marc.

[01:01:02] Marc Appelhoff: Thank you very much, Tilman. Have a great day.

Disclaimer

[01:01:04] Tilman Versch: Bye-bye to the viewers as well. Thank you.

As in every video, also, here is the disclaimer. You can find a link to the disclaimer below in the show notes. The disclaimer says always do your own work. What we’re doing here are no recommendations and no advice. So please, always do your own work. Thank you very much.