With Ryan O’Connor of Crossroad Capital and Todd Wenning of Ensemble Capital, I had the pleasure to take a deep dive into Nintendo. Here you can find the video and the transcript of our conversation.

- Check out Interactive Brokers

- Introduction

- What both learned from each other on investing and Nintendo

- The change in the role of gaming in society

- Nintendo and the gaming market

- The boom and bust cycle – still active?

- Nintendo’s target groups

- The hardware and software interaction

- Creative use of hardware and software combined

- Nintendo OS

- Nintendo accounts

- Switch online paid memberships

- The change in buying Nintendo games

- Nintendo’s pricing policy

- Is the Switch profitable?

- Selling in game and selling software

- Third party games

- (Buying) Engagement

- Nintendo’s management

- Nintendo’s flywheel

- The revenue potential of the optionality’s in Nintendo’s business

- The bear case

- Disclaimer

Check out Interactive Brokers

This episode of Good Investing Talks is supported by Interactive Brokers. Interactive Brokers is the place to go if you are ever looking for a broker. Personally, I use their service. They have a great selection of stocks and accessible markets. They have super fair prices and a great system to track your performance. If you want to try out the offer of Interactive Brokers and support my channel, please click here:

Introduction

[00:00:00] Tilman Versch: Hello, everyone. It’s great to have you back. Today, we are having two rock stars investing here to talk about Nintendo. I planned very long for this intro, so I hope it works out. I think we will set the ring on fire today and switch the conversation on. Let’s get it going. Welcome to you, Ryan, and Todd. It’s great to have you here. I always have to not try to ask or try to say Toad instead of Todd every moment, especially with this topic. Before we start, I want to show the disclaimer, but I want to also give you a kind of different introduction because I prepared the question that I want to ask, what did you learn from each other about investing and/or Nintendo? You can just drop one point here because we’ve got any questions, but give it a think, what you learned from each other about investing and/or in Nintendo is the question here.

But before you can answer, I want to just briefly show the disclaimer. The disclaimer, you can find a link below, says, “Always do your own work. This is not investment advice. We are making no recommendations. Please, do your own work and do your own research before you invest and be sensible about how you invest your money. Thank you very much.”

Back to our conversation. What did you learn from each other about investing and/or Nintendo?

What both learned from each other on investing and Nintendo

[00:01:37] Todd Wenning: Yes, I had known Ryan on Twitter for a while, and then I can’t remember how I came across his report on Nintendo, but I read it and I thought and still think that it’s one of the best reports on any company I’ve ever read. It’s just so well done and so well thought out.

Being a Nintendo fan as a kid myself, all of a sudden, things just started clicking for me in terms of my own thesis and building my own conviction about Nintendo, so hats off to Ryan for a great report. Actually, it took me a while even after I read it, to put the two together. I think I sent Ryan a message on Twitter, and I was like, “That was you? That was awesome.”

Twitter’s a small world and the finance world is a small world, so I’m just thrilled to be connected to an analyst like Ryan and learn from him, and just completely opened up my understanding of Nintendo as a business. I’d always been a fan, I’ve been playing Nintendo since I was six or seven years old, but I never put together the pieces of the business as a potential investment before, so kudos to Ryan.

[00:03:04] Ryan O’Connor: Thank you, man. I’m flattered. It’s kind of a similar thing on my end, I’ve been following Todd’s work and ensemble for years. I think that was the first thing that I responded to him, I can’t remember what I particularly noted, but all their work, from portfolio management to how they think about their high-level frameworks and integrate that into their process.

We’ve talked so much about Nintendo, back and forth, to say what have I learned, I don’t even know where to begin in our back-and-forth contests. It’s one of those things, you talk to someone long enough, it’s like, “Why do you love your mom?”

[laughter]

It’s not just one reason, it’s 30 reasons or a million reasons. When you reached out and threw out the idea that we should all get together and do a little kind of campfire discussion on my favorite business, it took me about two seconds to say yes. I couldn’t be happier to be here with you guys, and hopefully, something good comes out of it. It’s a lot of fun, thank you both.

The change in the role of gaming in society

[00:03:57] Tilman Versch: We’ve already built the bridge to the next question because it’s the question if you go back in your younger years and think about the role of gaming in society, how has that changed and what’s the impact on Nintendo in your eyes?

[00:04:48] Ryan O’Connor oh Todd, I’m going to let you go with this one.

[00:04:52] Tilman: You already mentioned that you’re a player.

[00:04:55] Todd Wenning: Yes, I was a certified Nintendo fan when I was a kid and still I am. My parents, when they were moving out of their house, found a letter that Nintendo had written to me. I used to write Nintendo all the time as a kid, saying, “You should really do a game like this.” Or “Here’s how you can make a baseball game better.” They probably got annoyed with me and said, “Well, just send you a letter and stop sending these letters. We’ve been getting them. We get them.”

I’ve been a huge Nintendo fan since I was a kid. To be honest, I kind of lost my connection with Nintendo probably after Nintendo 64, maybe GameCube. I think GameCube was my last Nintendo product. I hadn’t played for a very long time. Really, it wasn’t until Switch that I got back into it. Now sharing it with my son, it all kind of comes back. My son is six. We started playing Nintendo together and it’s just incredible to see how well we bond over that.

I think that’s a really interesting thing about Nintendo. I mentioned this in the article that I wrote, which is the first time where Nintendo can be passed down in generations. I’m going to be 40 this year, which is hard to believe, but I’ll be 40 this year.

[00:06:16] Ryan O’Connor: I turned 40 yesterday, by the way.

[00:06:18] Todd Wenning: Happy birthday, happy birthday.

[00:06:20] Tilman Versch: Happy birthday.

[00:06:22] Todd Wenning: It’s interesting that Ryan and I are kind of in the same age group. We grew up with Nintendo our whole lives. Think it came out when I was four here in the US, so we’ve grown up with it our whole lives. Now that we have kids of our own and we’re passing that down, it’s interesting to see that happen.

The age groups maybe five years older than us didn’t grow up with Nintendo as long as we did. It wasn’t part of their lives and gaming in general. I think that’s one thing that’s really changing versus the past 30 years. Now, it’s becoming family entertainment. I think Bernstein had a great chart of their survey, I think, it was in 2013, 37% of parents said they played video games with their kids weekly. Four years later, that jumped up to about 67%, 70%.

Now, it’s becoming family entertainment. I think Bernstein had a great chart of their survey, I think, it was in 2013, 37% of parents said they played video games with their kids weekly. By four years later, that jumped up to about 67%, 70%.

Todd Wenning

It’s becoming just this demographic wave where kids that grew up playing Nintendo are now playing it with their own kids and it’s becoming a family entertainment. It’s a completely new arena that we have yet to see how it unfolds, but looking at other businesses where exporting franchises, for example, where things get passed down generation after generation, that’s a really positive kind of pattern and analogy to type Nintendo into, is that it’s going to build stronger over generations because it’s how generations can communicate and connect.

[00:06:56] Ryan O’Connor: Totally. I’d add there was a, in my original thesis in the annual letter my director of operations forced me to cut it down quite considerably, which is kind of ridiculous given it was 70 pages, but I had a section in it that I called weaponized nostalgia. That kind of goes back to, and I think Todd kind of hits it right on the head, I can remember some of my earliest memories. It was Christmas, it was like ’86 or ’87. I can remember, all I wanted was a Nintendo.

I remember, amusingly enough, my parents and my aunt and uncle, they had mismarked the Christmas present and my cousin Andy ended up getting my Nintendo, which temporarily broke my heart, but it was funny. I was with my family at my 40th birthday party and one of the questions from my fiancé was, “What are your favorite memories each decade, the ’80s, ’90s, and so forth? I laughed, but in the ’80s, I think my chief achievement was getting the Whistle and the original Zelda. I think it was the seventh dungeon if I remember correctly. That kind of stuff stays with you in a deep formative way.

I imagine my parents’ generation, it was cars or maybe Disney’s the better example where they grew up with Cinderella and Robin Hood, that kind of stuff. The first thing that they reached to do with their kids is recreate those memories with the touchpoints that define their own childhood. I think what Todd’s speaking to, and this long-term gale-force tailwind is demographic. We’re all gamers now, essentially. You look at the demographics, split 50-50, male and female. The average gamer, I think, is in their mid-30s. I used to know it exactly, but pretty evenly distributed across age groups. The implications of video games going from something considered a childish hobby to a mainstream form of cheap fun and entertainment.

We’re all gamers now, essentially. You look at the demographics, split 50-50, male and female. The average gamer, I think, is in their mid-30s. I used to know it exactly, but pretty evenly distributed across age groups. The implications of video games going from something considered a childish hobby to a mainstream form of cheap fun and entertainment.

Ryan O’Connor

I have this internal metric which I call the price-to-fun ratio, especially in an environment like the pandemic. The value-add, not just in terms of your own personal fun, but the ability to use the Switch as a tool to interact and build experiences with your own kids is a unique and special thing that I think is going to benefit the business for a long time.

Nintendo and the gaming market

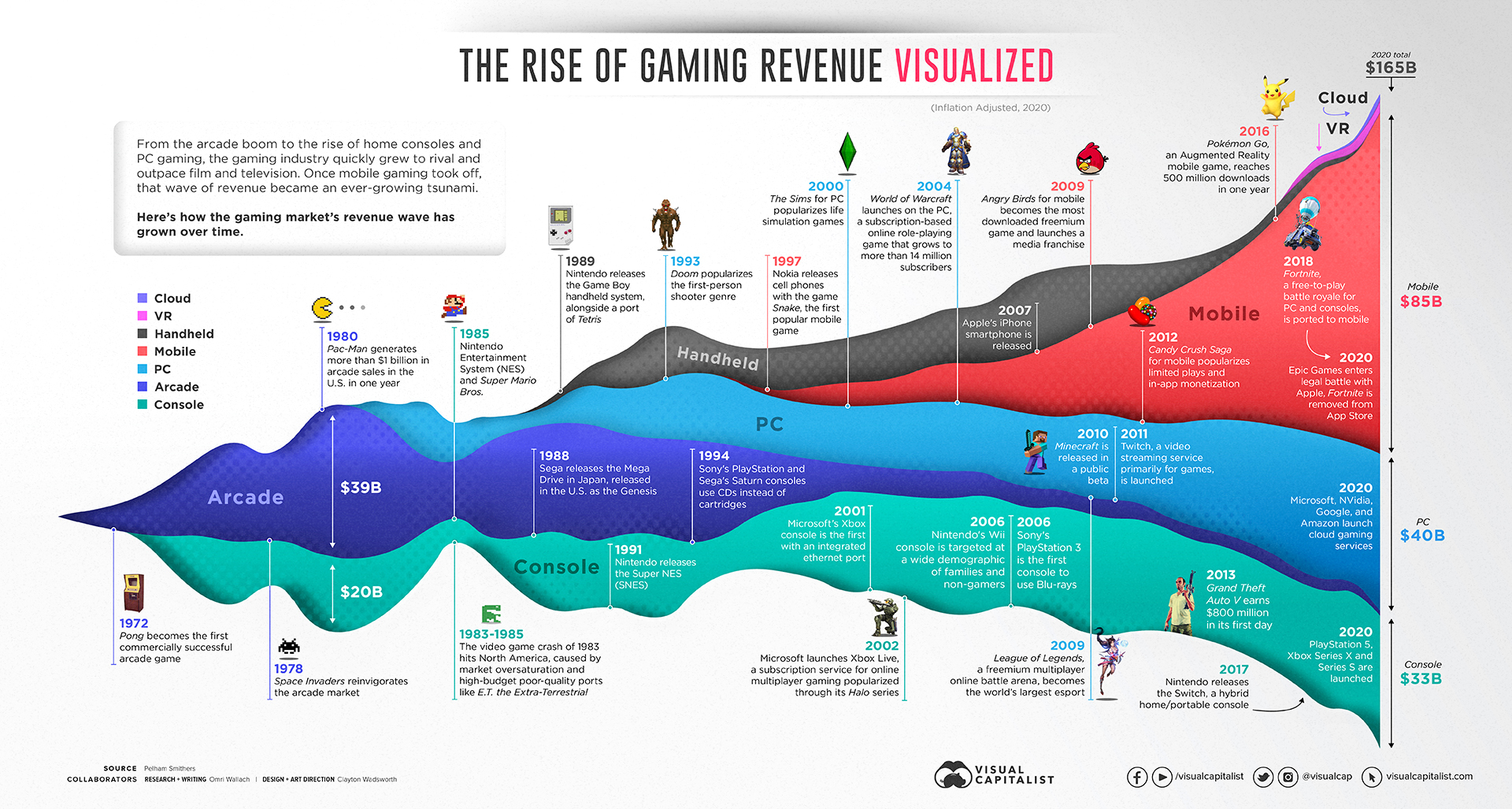

[00:09:33] Tilman Versch: The Twitter audience asks us to invert and play devil’s advocate. So, I want to take this role as well, even if I’m bullish and full disclosure at this point, also own some Nintendo stocks I want to share a graphic with you from the Visual Capitalist. This is the whole gaming market. And as you can see, it was quite dominated by consoles and PC and mobile took over. So, the question that came up and often comes up is did Nintendo lose it in this market? If you see that, the console market isn’t growing that much. What is your take on this?

[00:12:07] Todd Wenning: Yes, I’ll take a shot at it first. I think that’s the big bear case, is that the world is changing around Nintendo and Nintendo isn’t keeping up in that Nintendo is stuck in this boom, bust console cycle. A couple of things about that.

[00:12:24] Tilman Versch: I also have graphics of this. Let me switch to it. No, it doesn’t work. Okay, I’ll present it in a second, so you can make your argument.

[00:12:34] Todd Wenning: Sure, sure. We’ve discussed this with the team. We try to take apart the bear case and make it as strong as we can, so we understand it really well. I think the key for us, and I think this is why Nintendo hasn’t aggressively pushed into mobile, is, there’s something about entering into the Nintendo World before you consume the content.

If Mario was on Game Pass or something, would it feel the same? I don’t know. It might be different for me. I think that’s what Nintendo is trying to… They’re trying to develop an operating system, of course, what you’re doing right now with Switch online from which Nintendo accounts, including their mobile, I think that will help stick the user base together going forward.

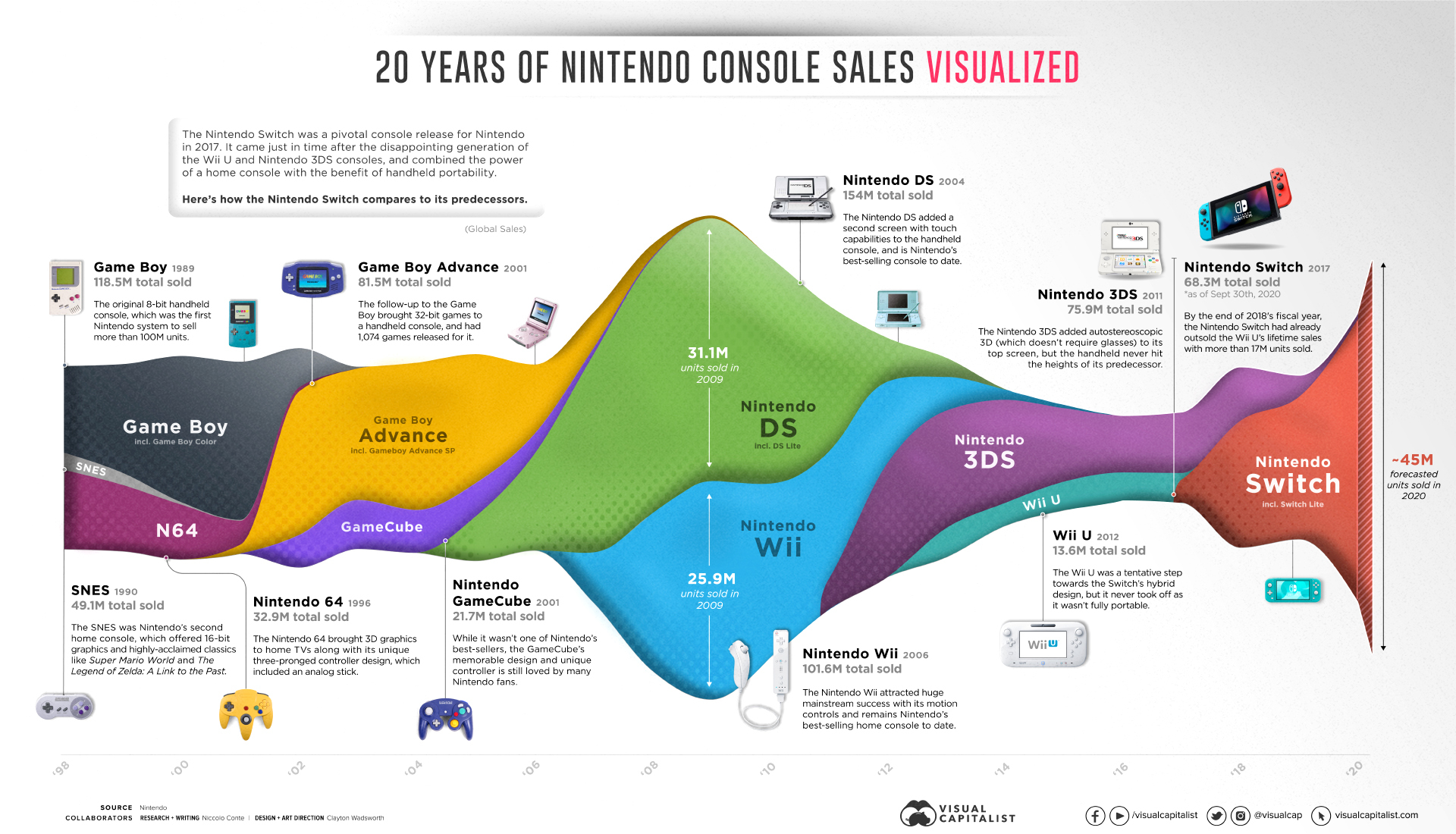

Now, if you look at the Nintendo consoles over the past 15 years or so, you see them stacked against each other, you can look at that and say, “Well, there’s six or seven different consoles there,” and Nintendo had to re-win every single one of those customers every time they launched a new console, which they did.

[00:13:42] Tilman Versch: Now we see it.

[00:13:43] Todd Wenning: Yes, we think about it differently. It’s more of a constant stream across. Even though they had to reset every time in the past, now their business model going forward should be different, where when you have new consoles, you’re not having to re-win those customers every single time. I think that’s where the bearish argument falls short to me, which is this impression that Nintendo is going to destroy the Switch, make everybody start over from scratch. That’s not going to happen.

Nintendos management, you can criticize Nintendo’s management. There’s plenty of criticism out there online, but you have to give them credit, I think, for creating this IP that remains incredibly relevant over the past 35 years. That is not easy to do when you think about all the video games from the ’80s that no one cares about anymore. Nintendo is still relevant to gamers today and to casual gamers. You have to give Nintendo’s management credit. I don’t think that they are going to destroy their business just to prove a point. I think they are going to adapt and they’re doing so with accounts you’re seeing. A key factor for us was seeing how they put Switch online on the Switch home screen, is saying that this is going to be a continual part of your experience. We are going to have a direct relationship with you, we want you to get deeper into the Nintendo experience.

We are going to have a direct relationship with you, we want you to get deeper into the Nintendo experience.

Todd Wenning

Even if they come out with a Switch Pro or even a completely different console generation, it’s going to be linked to your Nintendo account or your Switch online. You’re not going to have to start over, all this data is going to be continued over. It’s interesting that you see, if you complete a level on Mario Odyssey, for example, they give you the timestamp. Here is the date and time where you did it. I have to think that going forward, they’re going to be pulling those memories back. 10, 20 years from now, you’re playing another Mario game, they’re going to say, “Remember when you did this in that game?” It’s going to be just nostalgic going back to that. The bear case that Nintendo’s going to go back to, the thing they’ve done for the past 20 years, falls short to me.

[00:15:58] Ryan O’Connor: Agree across the board. I think Todd hits it on the head. Worrying about hardware, a big part of it was when you talk about units sold and the console business, I think a lot of that has to do with dynamics that are part of an obsolete paradigm. One of the things we always look for in detail in our larger search strategies is business where there’s a hard delineation between the past relative to the future. I think that’s a big piece of it.

One of the things we always look for in detail in our larger search strategies is business where there’s a hard delineation between the past relative to the future. I think that’s a big piece of it.

Ryan O’Connor

One of the bear arguments I’ve often heard or at least the ones that you get pushback on– I did a piece in Bloomberg where they go back and forth between the bears and the bulls. One of the comments that you’ve heard from – I can’t remember exactly, I might be misquoting this, Matthew Ball, they talk about how the iterative hardware platform sitting at the center of a software-based ecosystem, the doubts related to that have to do with Nintendo’s love of hardware and keeping that Apple-like hardware, that software-hardware integrated model together.

I laugh at that because besides what, for me, was originally conjecture and now is an objective fact, the whole point of an iterative hardware model with a software-centric ecosystem that they build on overtime is that frees Nintendo up to iterate on the hardware side forever in new and creative ways. You see Mario Kart live, you’ve seen Labo. The whole point outside of reducing the cyclicality of the business, improving the quality of its earnings, improving the diversity of its earning streams, all of that stuff.

I think if you are Nintendo and your goal is to put smiles on people’s faces and bring people together as opposed to isolating them, this Nintendo 2.0 maximizes their creative freedom to just use hardware.

The boom and bust cycle – still active?

[00:19:18] Tilman Versch: Let us dive deeper into the hardware a bit later because I want to go back to another graphics on the boom-and-bust circle. I want to give an idea from the stock market perspective because that’s what you’re interested in as well. So, this is the long-term chart of Nintendo. You see this kind of – you also saw it in the other chart with the switch – we see sales peak and you see it here again with the Wii sales, this historical pattern. What is your take on this historical pattern and how it’s still at the head of the stock market and the investor community?

[00:19:57] Todd Wenning: I think that the market is pricing as if you’re going to have a repeat of the Wii. You’re going to get this boom and bust, and Nintendo’s got to re-win everybody. What they’re missing is, again, going back to Switch Online is having a direct relationship with you as a customer.

I think that the market is pricing as if you’re going to have a repeat of the Wii. You’re going to get this boom and bust, and Nintendo’s got to re-win everybody. What they’re missing is, again, going back to Switch Online is having a direct relationship with you as a customer.

Todd Wenning

Imagine, for example, if they were able to, during the Wii era, the internet has progressed far, we have mobile technology that we didn’t have in 2006-2007 when we were so strong, imagine if they were able to capture your email and have your direct relationship with Nintendo at that point and they carry those customers through 3DS and then into Switch.

I think that’s a better way to think about going forward, is they’ve reinvigorated their installed base with Switch and now it’s about holding on to those customers. I think they’re doing that.

Todd Wenning

I think that’s a better way to think about going forward, is they’ve reinvigorated their installed base with Switch and now it’s about holding on to those customers. I think they’re doing that. You’re seeing them slowly roll out a more of a subscription revenue type of model starting with Switch Online. I think it’s about $3 a month for a family plan which is just small.

I could see Nintendo layering on different levels of that experience going forward. One dream that we have is that they roll out every single one of their legacy games – there you go. Roll out every single one of their legacy games for Switch Online so that you can go back, and you can play the GameCube, you can play the N64, all this part of a tiered, maybe, subscription revenue model.

I think there’s going to be a stickier revenue model going forward. I think the average Nintendo gamer paid the equivalent of about $9 a month last year, last fiscal year in terms of software. If we think about that compared to other entertainment experiences that we have right now with Netflix or whatever it might be, or Spotify, we’re paying $15 to $16, no problem for that. It won’t be every single Nintendo gamer that pays for that, but I think you have an opportunity to put more of a foundation on software sales going forward than you had in the past when it was all about hit-driven, first-party games.

I think the average Nintendo gamer paid the equivalent of about $9 a month last year, last fiscal year in terms of software. If we think about that compared to other entertainment experiences that we have right now with Netflix or whatever it might be, or Spotify, we’re paying $15 to $16, no problem for that.

Todd Wenning

Now you have this foundation of revenue that you didn’t have in the past that’s high margin and that’s going to completely change the way Nintendo generates cash in their business. We think the market has not reflected that reality yet. We think the price-earnings multiple currently is trading as if the stock is going back or the business is going back to what it was before. We don’t believe that’s going to happen.

[00:22:45] Ryan O’Connor: That’s absurd. That’s absurd. I’m just going to go out and say it: The valuation, obviously, speaks for itself. I think there are more than enough tea leaves. Again, when we put out the original thesis, not only was its kind of crazy radical relative to what the street had, in some sense, that was understanding the framework that they were using given the famous opaque nature of Nintendo’s management and their lack of disclosures. Initially, it was us spending quite a bit of time reading a ton and trying to piece together the larger mosaic of everything from management’s past commentary to just looking at the nature of the Switch at being mobile, basically, a tablet, a low powered tablet and using off the shelf generic chips.

You can look at it from a lot of different ways, but it’s like a giant green sign, at least in my mind, that this is the way forward. What used to be, again, conjecture, is now cold, hard facts. You can see it in a lot of different ways. When the piece was released, you had just the original Switch, then the Switch Lite came out. I think more interesting or more enlightening is, not only did they come out with the light and expand the total addressable market from a price point perspective, all that kind of stuff, but you also had an annual upgrade with a more efficient original Switch.

You’re starting to see that same pattern that you saw with Apple in a lot of different ways. When I look at that chart, I often wonder and ask myself what’s going to make the street wake up. A big part of it is the explosion of digital.

Ryan O’Connor

You’re starting to see that same pattern that you saw with Apple in a lot of different ways. When I look at that chart, I often wonder and ask myself what’s going to make the street wake up. A big part of it is the explosion of digital. I think it might have been Taylor Henderson. I know you guys are probably– He’s put a couple of great tweets lately and he isolated the digital component with the girl’s pop profile and did a Ben Graham riddle query “What’s this worth?”

[00:25:33] Tilman Versch: I think there it is.

[00:25:35] Ryan O’Connor: Yes, that’s wonderful. That gets to the point of building momentum across the digital side. Ultimately, what should, now doesn’t mean it will, I look at Apple, for example, I can remember just wanting to hit my head against the wall. This is 2013, 2014. The common refrain was Apple’s margins are going to get decimated because low-cost hardware is going to come and basically drive down margins, as a complete and total misunderstanding of the intrinsic nature of the ecosystem that Apple had built. They started, call it 2007, 2008, and there we are five years later.

The common refrain, if it took investors this long and granted, I think investors, in general, are more familiar with the nature of the model and what it is. I can remember thinking just how incredible it was five, six years into Apple’s own transformation that you still had such widespread, just terrible takes, what felt like at the time impossibly dense. I think that it won’t take nearly as long for people to wake up in the street, but the key here, in a lot of ways, psychologically, will be the release of the Pro, which I think will either come in March. I’m pretty sure it’ll come out.

Nintendo’s target groups

[00:27:22] Tilman Versch: Before we dive into the Pro, I want to go back to all and talk a bit about the total addressable market Nintendo has and about the target groups Nintendo has. I asked you to send in some emojis to display the target group Nintendo has. I want to present your results and ask you to comment on them as well. What are your target groups? Who Nintendo can reach out to? Who are their core target groups? There you go. [laughter]

[00:27:59] Ryan O’Connor: I love it. I love it.

[00:28:02] Todd Wenning: Yes, I think Ryan’s probably more on target than mine. Where I was coming from was: If you look at Nintendo’s core market, it is 90%, I think, male. I could be a little off by 5% or 10%, but it’s mostly men. Especially when we were growing up in the ’80s, it was primarily the boys that were playing. Those are the guys that will be transferring this nostalgia onto their kids.

I think it’s increasingly becoming female. This is not saying that female gamers are not part of the target audience. They certainly are. Nintendo has done a great job with it. Their primary focus or their primary target audience, though, in my opinion, at least in the United States is dads and their kids. You talk to dads who are playing with their kids and they light up when they talk about Nintendo.

You talk to dads who are playing with their kids and they light up when they talk about Nintendo. It’s really the torchbearers, so to say. It’s a pass down. It’s like with sporting teams like baseball, football, soccer, whatever it might be, it’s typically the dads who pass it on.

Todd Wenning

It’s really the torchbearers, so to say. It’s a pass down. It’s like with sporting teams like baseball, football, soccer, whatever it might be, it’s typically the dads who pass it on. Not always, but it tends to be that process. It binds together the grandparents with the parents and the kids. It’ll increasingly become more male and female, but right now, the primary target is dads and kids.

[00:29:20] Tilman Versch: Ryan, you have to explain your emotional storm as well.

[00:29:31] Ryan O’Connor: Yes, yes, yes. I completely agree with that sentiment. I think that’s actually an interesting point when you think about the torchbearers, which, in the ’80s and early ’90s, video games were much more kid-centric. Us, the people that grew up with this where it was a deep part, I had a buddy the other day that I hadn’t seen in a while. We were trying to figure out a way to get together and he said, “I should come over and we should play tech mobile.” I told him only if I can be the Raiders.

I play it with Bo Jackson as a Kansas City guy for obvious reasons and I like to win. I told him I would do it that way, but I think those are great points and yes, we’re all gamers now in a kind of a different way. But when I think about who is going to be the real driver of this larger trend towards diversification in terms of male, female, and the rest, it’ll be dads geeking out over the new Zelda and trying to introduce it to their son that I think will play a very large part in it.

For me, personally, this was just my expression of the fact that, one, I think one of the amazing things about Nintendo and its IP is it’s so rare to have such kind of universally beloved, not only a mind shares in terms of recognition of characters, but the scarcity of truly global family-friendly IP that works kind of cross-culturally and globally.

Ryan O’Connor

For me, personally, this was just my expression of the fact that one, I think one of the amazing things about Nintendo and its IP is it’s so rare to have such kind of universally beloved, not only a mind shares in terms of recognition of characters, but the scarcity of truly global family-friendly IP that works kind of cross-culturally and globally.

I think Nintendo fits squarely in that sweet spot of just incredibly scarce and rare forms of entertainment that will work everywhere. Nintendo’s motto is to put smiles on people’s faces. The bunch of the smiles at the end is to represent that, the rest is to speak to the diversity and just the universally beloved family-friendly nature of their properties. Then the bottom one was my poor attempt to be amusing from an investor’s perspective. That’s kind of what’s there.

[00:32:23] Tilman Versch: This collection by Ryan also fits perfectly if you want to play Mario Kart 8 online. You see it played globally. There you see just people represented like this, you see the flags there from different countries, and you also see different cultural backgrounds

[00:32:39] Ryan O’Connor: Yes, I mean that that’s kind of, it’s the network as, as Switch online and as, as Nintendo modernizes maybe at some point we should talk about cloud and how that relates to an agenda future. If you look into their financial statements, I mean, there’s a couple of interesting things, but I can’t remember exactly. If it was the quarter before last or whatnot, but you saw a massive in USD, 150 million in incremental spend that given the size of the investment couldn’t be, I think individual it certainly wasn’t hardware related say with the Pro to me, the only thing that makes sense of, I kind of uptake and it looks even more interesting. And if you kind of go back the last 20 years, as long as the financial statements that I have but it speaks to more in-depth work, cloud-centric, global future. And I think that’s what you are kind of getting at, is

[00:33:49] Tilman Versch: But before we go to the cloud, maybe let’s try to dive deeper into this…

[00:33:55] Ryan O’Connor: You’ve got to keep me reigned up. I’ll go off on a tangent and have nothing to do with the original question. Pull me in.

The hardware and software interaction

[00:34:00] Tilman Versch: I want to talk about the hardware, and software interaction. I prepared something for the viewers so that they get an idea. Maybe you can also comment. These are the Joy-Cons, the controllers of the Switch, and you can easily use them here. If I put it in the right direction for the Ring Fit and use them as a device to play this kind of game and use them to coordinate this tool. In some games, even in Mario Kart, you have the wheels, and you can use them to play with the Joy-Con as well. In other games, you have this kind of sleeves…

[00:34:40] Ryan O’Connor: This is the endless iteration. When it comes to hardware, by the way, you’re starting to see all the different ways in which the crazy geniuses at Nintendo can basically perpetually release new gadgets, ways to play ways to have fun with the software. And I think that’s very, very cool.

[00:35:08] Tilman Versch: This is a setup with like Fitness Boxing, for instance, or Just Dance. So, you have to sleeves that it doesn’t fall out of your hand and you can use it to play boxing, playing tennis or something like this.

This interaction of hardware and software I find very interesting about Nintendo. It gives me the confidence that there is still hardware needed in the future. And people not only ask: Why don’t you just play it on the mobile phone? And I think these are some ideas you can get why this kind of interaction is needed. You can also take your pulse at this side of the Joycon here. You can collect data with it, so you can better do sports with it.

[00:35:58] Ryan O’Connor: Todd have you played Ring Fit by chance?

[00:36:00] Todd Wenning: I haven’t, but I really should just as due diligence, right?

00:36:05] Ryan O’Connor: Yes, they’ll kick your ass, or it kicked my ass, but I can get tired going up the stairs if I’m not careful now that I’m 40. I was actually delighted with Ring Fit. If there’s one complaint we can get into management, it’s that they don’t kind of fully press and leverage their inherited advantages. I’d love to see a subscription biz with Ring Fit. I remember one of the things Todd reached out for, and I can’t remember the game, but it was the jump rope game, just simple in so many ways. This is actually what has driven the explosion in China and the main driver of mind share and sales has to do with Ring Fit.

Your kind of see this everywhere, but this is why I think for Nintendo, while I can see Nintendo Switch online and, for example, partnerships where maybe Nintendo, for an Xbox Game Pass, they’ll give a limited number of marquees, software titles that are…The breadth of the Wild 2 is on the way about to come out. They can give X Pass, the original Breadth of the Wild, and Mario Odyssey, maybe Mario Kart 8 from the prior thing, but marquee properties that will not affect incremental software sales on the next generation when it comes to this thing.

At the end of the day, I think hardware and merging the two creates a level of – it can be a community, it can be just personal fun, but I think it’d be a tragedy if they ever. I don’t think it’s an either-or. I think it’s both-and. I think they can continue to build on the Switch family of systems and continue to create new forms of interactivity, whether it be something like Ring Fit Circle. It’s a both-end.

I think they can continue to surprise and delight people with new forms of interactive hardware, but also expand and grow the digital business by selected partnerships. That’s the beautiful thing about the new model. I mean, there are just so many ways that Nintendo can create billions and billions of dollars out of what is basically thin air.

I mean, there are just so many ways that Nintendo can create billions and billions of dollars out of what is basically thin air.

Ryan O’Connor

Creative use of hardware and software combined

[00:38:45] Tilman Versch: What are other examples of this kind of creative use of hardware and software? Viewers can also look at these examples to understand the complex relationship between hardware and software.

[00:38:58] Ryan O’Connor: So, Todd, you just got a Labo, right?

[00:39:01] Todd Wenning: Yes.

[00:39:02] Ryan O’Connor: There are quite a few different applications with Labo. There’s a very weak VR component, but I think that hints at the future, both in terms of VR and AR, of what can be done. You have the Joy-Cons themselves, which I think have tons of embedded optionality, what you can do there like the Marla. There’s Mario Party, and then what was one of the first releases that came out? It was like 21 games or something like that?

[00:39:41] Todd Wenning: The clubhouse games?

[00:39:44] Ryan O’Connor: Yes, just the Joy-Cons alone, I think, will give you a wide diversity. The Labo works in a lot of different ways. I think Ring Fit and its applications for other uses. I don’t know if Mario Kart Live is a new form of hardware where you basically get a live Mario Kart controller, and you can create tracks within your house. I think without getting into rumors of potential iterations with the Pro that is coming out. I think there is already a substantial suite, if you will, of relatively low-cost, affordable innovations on the hardware side that I think will continue to expand and grow with time, especially as incremental Switches get more powerful, and what can be done with the hardware utility expands.

Imagine the Pro coming out with a camera where you can start to use your actual Switch playing something like Pokémon Go on mobile. I’m a huge, hopelessly addicted fan of Mario Kart Tour where I think I’d give 10, 15 minutes a day in clockwork if I could play Mario Kart Tour on my Switch, even without, say, an AR, or some new form of VR component, I would.

I think all this stuff ultimately increases the utilization of the hardware. In video games, unlike some businesses like Netflix where you have a subscription business, operating profit isn’t going to spike. If subscriptions have a huge uptick, obviously, you’re going to make more money from that revenue, but in video games, there’s a linear relationship between player engagement, utilization of the system, and profit per user. In something like Netflix, you could watch 50 movies a day, and Netflix isn’t going to make more money. I don’t know where I was originally at.

[00:42:12] Tilman Versch: We were at the hardware/software complex, and I want to ask, do you have something to add?

[00:42:19] Ryan O’Connor: Are you talking to me?

[00:42:19] Tilman Versch: No, the other guy of the two, yes. [laughter]

[00:42:25] Todd Wenning: I think the hardware is a special component of the Nintendo experience. I mentioned earlier that I don’t know that Nintendo IP on another platform feels the same way as it does when you enjoy it through the console or through Nintendo’s operating system. Even if you were to eliminate the console itself, and it was all cloud, I think Nintendo would still be wise to produce hardware components that are innovative and fun to interact with.

Even if you were to eliminate the console itself, and it was all cloud, I think Nintendo would still be wise to produce hardware components that are innovative and fun to interact with.

Todd Wenning

We’ve talked about this on the team as being sort of like going to an amusement park. When you go to a Nintendo park, you want to see Mario, you want to see Yoshi, you want to see Donkey Kong. Imagine going to a Disney park and seeing Mario, it wouldn’t feel the same. You want to get into that mindset of, “I’m playing Nintendo IP.” I think that’s one reason why they haven’t aggressively pushed outside of the walls the way some bulls have called for, to say, “Hey, go out and do digital. Look how much money you could make.” I think it dilutes the experience a little bit and I think that’s why they’re really cautious about doing it.

[00:43:40] Ryan O’Connor: Yes, I think back, my earliest Nintendo memories are blowing in my cartridges, to press them in and somehow to get them to work again. I think that speaks to the type of thing Todd is talking about. It’s kind of je ne sais quoi, it’s hard to explain, but I think having a dedicated gaming platform, especially one as versatile as the Switch, where not only can you play at home, but you can take it on the go.

A cell phone in some ways, ergonomically, can be helpful with certain types of games, but ultimately, I think the optionality from a gamer’s perspective, the types of fun they can have, the types of games that they can experience, the immersiveness of that experience in many ways is tied to hardware. Removing that piece of the puzzle isn’t going to win me very many friends. Because from a short-term stock perspective if they came out and they did away with hardware, you might see the stock double or triple.

When I think about the long-term, their moats, and building shareholder value, I actually think it’s the opposite. I’m glad they’ve maintained their strategy. When you have the hardware, that’s a big part of the mode too. If you look at Apple, they will have a very different outcome if they had gone about things in a different way in terms of ensuring that elegant and beautiful integrated hardware-software solution. I’d be disappointed. The good news is I think there is: Nintendo has a better chance of getting bought out than giving up the hardware side of things given how integral it is to the experience.

Nintendo OS

[00:46:01] Tilman Versch: Let’s go to the software side. I hope you can see the Nintendo OS here. I want to give the viewers an idea about the Nintendo OS. Also, I hope I hit the right button for the Nintendo eShop. Maybe let’s first start with the OS. What’s, in your eyes, the power of the Nintendo OS? Then let’s make a turn to the eShop. But let’s first go with the software architecture Nintendo has.

[00:46:30] Todd Wenning: As I mentioned earlier, I think it’s about having that OS and continuing to use that OS to improve it over time. Again, it’s like your iPhone or whatever. Like Your iOS or Android OS. That’s your operating system. Everything that you do connects back to that operating system. I mentioned earlier, we’d love to see them release all their past party games and make it part of a higher-priced switch online product.

Right now, you can get a few games from Nintendo legacy and a few super Nintendo games and legacy but imagine if they unlocked all of them from GameCube to Nintendo 64, that would be just a huge opportunity.

Todd Wenning

Right now, you can get a few games from Nintendo legacy and a few super Nintendo games and legacy but imagine if they unlocked all of them from GameCube to Nintendo 64, that would be just a huge opportunity. This isn’t just me guessing, when Nintendo had their emulators, I think the last – they had 30 games on it. It was like you could buy a replica of an original Nintendo, but it came pre-loaded with 30 games. I think they sold – the last time they shared – it was 10 million units. People are willing to pay, I think it was $80 or so, to buy these old games that you would think that no one would play. The thing is, there aren’t any other games really that draw this demand today.

Going back to nostalgia, this is all that it is. I had a friend over to play. He was one of my son’s friends’ dad. It was about a year ago before the pandemic. We were bonding over Tecmo Bowl. We both played it growing up. It’s a completely unique experience for Nintendo. I think tying us back to the OS, I think connecting all those things back to this core experience with Nintendo is so important.

[00:48:32] Ryan O’Connor: Yes. I’d only add that if there are some of my favorite phrases in this business are untapped pricing power. When you think about the low-cost nature of where Switch online is relative to alternatives. There’s even some interesting data mining that has taken place with respect to things that developers have found in the code of the recent software update that I think hints to… there is an ambulator in it, for example. There are a lot of different ways in which that could be a tell in terms of the future. One of the absolute no-brainers in terms of low-hanging fruit that would not only drive up the tax rate, but I think the number of incremental ex-gamers that you can bring into the system.

I grew up with a Nintendo the SNES and then the Nintendo 64. I think I played the GameCube a little but those three games, Tecmo Bowl, Legends of Zelda – A link to the past on Super Nintendo, or The Legend of Zelda: Ocarina of Time. When it comes to real nostalgic crack that would bring me back to experience these old games, they go back, and they can either all at once or on a steady schedule laid out in not just all of their retro consoles. Basically, maybe it’s the greatest hits. Maybe it’s the entire library of the games they have rights to. I think the intrinsic value prop of Nintendo Switch Online, which is already quite strong and especially as they bolster it and make it a more modern network much like you see with Sony and Microsoft in terms of the Cloud. Imagine us, Todd, a year from now being able to play network Tecmo Bowl against all of us, get all the FinTwit and we can see who’s the champion.

There is a tremendous amount of embedded optionality that is simply begging to be unlocked and will be unlocked by layering not just the vintage consoles but at minimum the greatest hits across each console.

Ryan O’Connor

There is a tremendous amount of embedded optionality that is simply begging to be unlocked and will be unlocked by layering not just the vintage consoles but at minimum the greatest hits across each console. In that way, you pull forward any older guys here across the generations that maybe have been on the fence, “Oh, here. You can go play your favorite video game growing up.” You get all of this for, I think, a price point that they could triple the price of Nintendo Switch Online with something like that. I don’t think consumers would flinch. I think that’s part of the future.

There is a tremendous amount of embedded optionality that is simply begging to be unlocked and will be unlocked by layering not just the vintage consoles but at minimum the greatest hits across each console.

Nintendo might make you want to rip your hair out, light yourself on fire on occasion, with their quirky contrarianism. And they’re going to do what they do, but on a real level, I always – I’m taken aback by just the attitude towards management. We can get into that in detail. By and large, when it comes to the things that matter, foundationally, I think they are killing it for lack of a better term. I think they’re focused on the right things. I think they’ve restructured the business in a way. Not only did they change I think the core business model, but they’ve also restructured their internal operations around that. They are working at their own pace, slow and methodical, but I think the right things are getting done. Assuming the premise is correct, and I think we know all of us to believe it is, that the Switch family of systems is perpetual, i.e., for all intents and purposes forever.

By and large, when it comes to the things that matter, foundationally, I think they are killing it for lack of a better term. I think they’re focused on the right things.

Ryan O’Connor

[00:53:03] Tilman Versch: Let’s go into one point here. That’s quite interesting. I also have prepared a chart for this.

[00:53:09] Ryan O’Connor: That’s right.

[00:53:10] Tilman Versch: I want to share the chart with you. Also coming through the Nintendo OS: Here are the Nintendo accounts that I created. Maybe you want to comment on this as well. Here is 2015. I think the chart is from September 2020. Over five years, they have over 200 million accounts. Maybe, could you explain why these accounts are needed?

[00:53:37] Todd Wenning: Yes, I think it all ties back to having this direct relationship with customers. This chart specifically shows you why this is not a repeat of the Wii. Since Switch launched, they’ve garnered almost 200 million accounts registered with Nintendo. Now, for the first time, Nintendo has 200 million-plus direct relationships with their customers and their users. Now, they can see how long you’ve been playing Zelda. Maybe you like this game. They have all this information they never had before.

It just shows me that they are really interested in developing these direct-to-consumer experiences similar to the way Disney is doing with Disney+. It was the first time that Disney had a grasp on how much Mickey Mouse content are you consuming. Think about the ways that you can do an analysis of the data now. Nintendo, this will definitely help them not only keep the relationships sticky, but it will help them create better content. I think that’s one thing that if you’re a skeptic about Nintendo, you look at that and say, “That’s amazing that they got that many that quickly, that many accounts that quickly.” It tells you that the IP is still extremely relevant, and people want to have that relationship with Nintendo.

Nintendo accounts

[00:54:56] Tilman Versch: What are the touchpoints to get an account and to give Nintendo the email? Is it just Switch games or users…?

Mobile’s included in that which I think is fascinating. Creating a direct-to-consumer relationship in a digital world and the increasingly digital world I think is incredible.

Ryan O’Connor

[00:55:07] Ryan O’Connor: Mobile’s included in that which I think is fascinating. Creating a direct-to-consumer relationship in a digital world and the increasingly digital world I think is incredible. It’s foundationally important with respect to maximizing your competitive position in the future and a sense of you get this data-driven feedback loop that allows you to incrementally optimize. Maybe not only your software lineup, but once you have the data, the things that they can learn are to improve and grow the business, I think is kind of really unlimited – or maybe a little bit unlimited is a bit hyperbolic, but you can see this with mobile.

One of the things that I wrote about the original letter that I’ve thought a lot about is the monetization models and the experimentation towards that end with the same Mario Kart Tour, for example, alongside that they came out with a subscription model and for a variety of reasons, especially given kind of the unique beloved nature of Nintendo’s IP and their fans. That, in my mind, solves the issues in principle with respect to mobile and Nintendo’s brand mechanics.

I love Mario Kart Tour, but when you pull the pipe down which releases gifts. You can feel the Vegas-like nature of that. While I think it’s a great way to make a lot of money, I think if you really are long-term and Nintendo is a business that it seems ridiculous, but personally, I love it. This is a business that has a hundred-year business plan. I think without getting into all of the benefits that relate to having this data-driven feedback loop and the reoccurring high margin nature of the revenue associated with mobile. You have a model that I think is fundamentally geared towards the biggest and most intense Nintendo fans that is a better business model that will just create more and more touchpoints.

This is a business that has a hundred-year business plan.

Ryan O’Connor

The Nintendo accounts, whether it be maybe, we’ll see with Super Nintendo Land, maybe they will integrate when you get your power band that you walk through the park with and collect coins and knock things like [crosstalk] right into the Nintendo account. I think the Nintendo accounts, it’s the central place that all of the elements of the expanding Nintendo flywheel can come together and having integration. I talked earlier about making, being able to play mobile games on the Switch. If Pro has a camera, being able to play AR that way. Imagine using your Switch, in the actual Super Nintendo land park.

Anyhow, I think that it is foundational to the foundation that they want to build long-term and all the separate touchpoints that they can use to broaden the Nintendo fan base and drive first-time and repeat interactions with our customers directly.

Switch online paid memberships

[00:59:09] Tilman Versch: Let’s go to one repeat interaction, that’s also quite good measurable: The Switch online memberships. I also have a graphic on this, and you’re invited to comment on it. This shows currently the 26 million-plus members of the paid service. Here are some marks where they got an increase through the release of games. One is Super Smash Bros.

It was smart of them to underprice this product. Almost absurdly underpricing.

Todd Wenning

[00:59:41] Todd Wenning: Yes, I think it’s a similar story with Nintendo accounts. It was smart of them to underprice this product. Almost absurdly underpricing. I think it’s for family access, I think it’s 34.99, in dollars less than $3 a month. Think about that in terms of your other subscriptions, that’s nothing. I’d be willing to personally be willing to pay $9.99, $14.99 for a deeper experience with more products. I think there’s an opportunity here. Again, going back to customers wanting to enter into a relationship with Nintendo that they haven’t been able to in the past, I think that just supports that.

[01:00:34] Ryan O’Connor: Totally. I’ll just add that that just shows the power of software is where Nintendo shines and as we head into this new year, I think we’ll have both the release of the Pro, but I think Nintendo is just going to carpet bomb consumers with world-class AAA IP games this year. Without going into expecting what they will be, I think this will be one of the most powerful years in terms of the breadth and depth, and quality of their software lineup and as Breath of the Wild 2 drops and Metroid 4. As these new long-awaited franchise and sequels to marquee franchises drop, I think you’re just going to see that that trend is going to continue to grow not only alongside the installed base but as with Animal Crossing, there’s a variety of Nintendo franchises that have been waiting for an update and have this embedded natural fan base that is chomping at the bit for their favorite franchise to come out.

As you’ve seen here as that happens, you are just going to – like how the indexation vortex has sucked up all the money in terms of driving capital flows in this current regime, I think you’re going to have a dynamic where it’s the full breadth and depth of Nintendo’s suite of gold-plated peerless IP hits the Switch. You’re going to have a similar effect where lots of people have been sitting on the fence both across demographics. They’re going to be pulled in incrementally at the margin as the – I don’t know the utility of the larger switch ecosystem continues to grow given the games and all the rest, the new hardware, in this particular way the Disney flywheel. I think the network effects are just starting to spin. I think they’re past exit velocity but we’re on that period where everything is just rapidly gaining momentum and I think people will be shocked where things balance out say two to three years from now versus what is currently embedded in this.

I think the network effects are just starting to spin. I think they’re past exit velocity but we’re on that period where everything is just rapidly gaining momentum and I think people will be shocked where things balance out say two to three years from now versus what is currently embedded in this.

Ryan O’Connor

What expectations are embedded in the stock price based on today’s valuation, I think the stock’s up 150% or something like that since we originally built our core position, but I still think the stock is mind-bogglingly cheap relative to what I think. Investing isn’t about being able to perceive the future, I think good investing is about understanding the present better than your peers. There’s no sure saying in this business. A lot of people want to – in investing -, they want things to be as they wish they were as opposed to the way they are. And the way things are right now, the valuation continues to shock me because I think if you’re willing to look a little deeper and peel back the onion, what used to be conjecture for me at least is now an objective fact.

I still think the stock is mind-bogglingly cheap relative to what I think.

Ryan O’Connor

The change in buying Nintendo games

[01:04:19] Tilman Versch: That’s like another level because I want to walk you through the way games are bought at Nintendo. I was at the store, the classical way and I get this, so this feels a bit like I was young when I did get the lego catalog. You could see some of the games that are released and get a certain impression to buy them at the store, bring the catalog home and see what games are there. I can say, “Hey, mama, buy me this. Something like this.”

[01:04:48] Ryan O’Connor: I want to know where Nintendo power is by the way. Why haven’t they reissued that maybe digitally? I don’t know, but sorry to interrupt.

[01:04:56] Tilman Versch: The classical way of buying a Nintendo game is going to the store or buying it online and getting this cartridge sent. There’s this digital chip inside. You can also say something about the special format because it’s no SD card. It’s a…format that is like the classical console elements or boxes you have to push in it. Then the next step of buying games is even from the store, getting a cartridge sent, but this time with a download code that’s on this card. You get a download code, and you can download your game. Get this code and add it to the store and to the Nintendo OS, games library. You connect it with your email address as well. The new way, I already showed it a bit, is buying it from the store and there. We’re all value investors, we just look for games that are on sales. We can see what’s there and just buy it. In my eyes, these are the ways to buy Nintendo games. Maybe we can talk a bit about the opportunity that lies in these downloaded digital games. There’s always a great chart for sharing knowledge on this. That’s your chart, Ryan, so you can start.

[01:06:23] Ryan O’Connor: Todd, you take this, because I think you were the first person – I think you caught it immediately. I don’t know if it was all of Europe or Britain, but the observation was look at them, they’re forcing digitalization and the adoption curve digitalization forward by…What was it? Were they removing the – you had that box, that physical cartridge, it really is a digital code. I think you tipped me off the various ways that they are moving towards that. Fingers crossed that the probe does not have a cartridge slopped just like you’re seeing with the PS5 and the new Xbox. They’re coming out with models that don’t actually have slots or spaces for the physical side of things. Anyhow, you go through that, then I’ll add my two cents on digital.

[01:07:28] Todd Wenning: One upgrade I would love to see in the Switch is a larger internal hard drive. Right now, if you download five or six games, you’re pretty much out of space on the internal hard drive. You have to go out and then buy a separate card to put into your Switch to store all the digital games you want to download. Just an extra step that may tell people – Maybe I’ll just buy the cartridge instead. I think that Nintendo really should be pushing digital a lot harder because the margins are just so much better. I think Ryan’s table had it there. At least 85% gross margin if they’re downloaded digitally versus 60% to 65%, off top of my head, in retail. Nintendo is relative to the other game publishers well below trend in terms of the percentage of games that are downloaded. I would love to see Nintendo be a little bit more aggressive in promoting its digital downloads because the margins are just great. From a user’s perspective, especially during the pandemic, I think a lot of people realized, “I can just download this game. I don’t have to go to the store to wait for it. It’s just here in about 20 minutes after it downloads”.

I think that Nintendo really should be pushing digital a lot harder because the margins are just so much better. I think Ryan’s table had it there. At least 85% gross margin if they’re downloaded digitally versus 60% to 65%, off top of my head, in retail.

Todd Wenning

Then you also have a direct connection to Nintendo and can update your game as you go on. I think there’s a huge opportunity for Nintendo to push it. Some of the reservations are that Nintendo having more kids in their universe than some of the other video-game publishers, parents and grandparents like to give the kids gifts and the best way to do that is physical. It’s a little less ceremonious to just give a digital download code. You want to say, “Here’s a physical copy. I wrapped it for you” and “Here’s a nice gift.”

I think Nintendo has a lot of that going on. I think they have some good relationships with their distributors in the physical world, so I don’t think they want to undercut them. During Black Friday sales, you’ll see the games deeply discounted at Target or Walmart, or Amazon, but the eShop will still be at $59,99. It’s very frustrating because you want to buy that game too, but you have to– Should I buy the physical copy or should I pay up for the digital one? Nintendo doesn’t compete really with its retailers on price too much. They have their own deals that come out but usually, they aren’t concurrent with a physical retailer. I think there’s a huge opportunity and we would love to see Nintendo’s software mix go, I think it’s about 45% now, to about 85%. That’s where we think things are heading. I think the pandemic pulled that demand forward showing people who didn’t want to go to the store in March, April, May of last year that “Hey, I can just download these games.”

It’s a better experience in my opinion versus going to a physical retailer and taking up shelf space with a bunch of cartridges. To me, it’s much easier. If I lose my Switch or if I lose my game, I can just download it again, and there it is. It’s a much better experience all around, in my opinion.

[01:10:45] Ryan O’Connor: Yes, I couldn’t agree more. I think what’s interesting about the digital code within the physical cartridge, I think that’s an interesting halfway point, by the way. That’s why when you sent me that, I felt that’s so interesting. It’s that it’s a way to continue to hold on to the poor relationships in terms of distribution. At least you’re going to save on the packaging. There’s a cost that will be running out there versus just going straight to the eShop. That might be a temporary bridge to, I think, what will eventually be an all-digital world.

When you think about physical media, in general, within the entertainment industry, when was the last time anyone went out and bought a DVD? I have no idea. When was the last time I saw a laptop computer with a disc rack? I can go on and on. If there’s a long, unstoppable trend, it is that physical media and physical forms of media are on the way out. I would agree in terms of where the mix shifted the fact that Nintendo was so far behind and now you have this temporary period of catching up. I think within a relatively reasonable time horizon, you’re going to see that shift closer towards calling it 80%, 88%.

One, when you actually go through and you do the math on the impact of its financials, it will make your eyes bug out. I think ultimately, they’ll get to a point where it just doesn’t make sense to put the money into physical, and then at that point, it will go 100% digital. It’s a similar thing to why Microsoft and Sony have come out with all-digital editions at a lower price point. I think like that cartridge example with the digital code inside, these are smart and creative ways to bridge that gap and push this trend along.

But in terms of the impact on the financials, I can remember in the heart of – in March as everything was basically imploding. Going back and thinking through what the impact would be and trying to pencil out the math, one thing was clear. It was pretty early, which was that if you look at what was happening in China and other areas of the world, in some areas it was small but gaming in general in terms of utilization had just absolutely exploded. Given where everyone is in a stay-at-home world where everyone is locked in and they can’t go anywhere, this dynamic introduced the experience of buying digital to a wide swathe through habit or various other reasons, people that have grown up going to the store and buying an actual physical copy. I think Todd’s discussion on the value proposition to the consumer, not even considering the publisher which was one of the things that the chart that you showed, it’s a win-win-win for everyone.

No longer do you have to go around and call around to your local GameStop and cross your fingers and have a prayer stashed in that the game you want that’s about to drop, that there’ll be inventory there, or by the time you get there it will be gone. The time and expense to get in your car and go drive it versus just simply picking up your Switch, going to the eShop, downloading it, 12:01 after the day of release. You wake up the next morning and it’s playable, ready to go on your Switch. It’s like Netflix. As I first started to get used to watching Netflix, it didn’t take very long for me to go back. To this day, when I watch linear ad-supported TV, it’s like my brain explodes. I want to jump out a window. It’s crazy to me. [chuckles] Because of the disruption going on there, it’s like the number of commercials continues to grow.

It just got to this point where the– I guess what I’m saying here is that what the payment is done because brought forward, has not only accelerated this digital mix shift, but I think this demand has largely, permanently been pulled forward and accelerated a trend that has tremendous implications. When I went through in March and did the math, assuming, given the incremental sales that the platform – I’m trying to think of the average installed, the next year or two, extrapolate based on a reasonable tie ratio what the software unit sales would be.

Given I didn’t really assume any additional growth outside of the pandemic, just the natural uptick in software sales as each year, the average installed base gets bigger and bigger and bigger. I assume the mix shift was that digital went somewhere between 50% and 75%, and in a lockdown world where everything’s closed, and buying physical has literally been taken away from you, let’s just move that needle to 75%, 80%. It just hit me in the face, which was basically this, that EPS doubled simply on the corona-driven shift towards digital. Disavow or don’t even include all of the things going on in the business elsewhere, when you see EPS doubling.

In March, my concern was you might look, you might buy something that looks cheap based on trailing 12-month math, but when its earnings power gets cut by 90%, who cares if it was trading at 3 to 10– whatever the multiple looked like in the past. I spent a lot of time; I wanted the opposite. It’s either what we own or what we can own, where are stocks or businesses whose valuations have been destroyed as if their earnings power is about to get cut in half when in reality, it’s about to grow substantially. I think Nintendo hit that perfect– they hit that framework perfectly.

I remember adding, I got close to bottom-ticking it at 37, 38. It was just such a strange feeling because anyone can do this math. You don’t have to be a particularly savvy or gifted analyst to have figured this out. It was staring you in the face based on what we were seeing everywhere else in the world. I think the two biggest elements of this thesis, at the end of the day, the only things that need to– as far as premises that need to be true, to have a tremendous amount of low-risk embedded upside here, is the decyclification of the hardware business towards an iterative hardware model based around a software-centric ecosystem. Then, equally as important I think the long-term secular transition towards digital. You add those two things together and [crosstalk] is pretty impressive, relative to the stock price. Let’s just put it that way.

Nintendo’s pricing policy

[01:18:57] Tilman Versch: How shareholder-friendly and customer-friendly is this transition? I want to try to figure this out because if you buy this code you have a problem because you can’t resell it anymore. Many people say they want to keep the SD Card, or whatever you call it, to have the probability to resell it. Then another question about consumer versus shareholder-friendliness with Nintendo is the pricing policy they have. I also have two charts on this, so I’m happy to share. This is from price comparison machines, like the Germany Idealo. It shows the price of the Switch, like a three-years or four-years-old, hardware device and this is the price in the last year.

It has been steady, but can I also say: “Okay,” that’s only the price from the pandemic where a lot of demand happened, but this is the comparison from the UK, and this is the price going back to 2017. Do you see it? It’s just like some discounts happened, but it’s steady, there’s no price decline. What is your take on this? And does Nintendo earn money if they sell Switches or is it a loss-making business they have there?

[01:20:18] Todd Wenning: Well, I think the key to those charts just show is ricing power. People are still willing- I think that some of the top-selling games for Nintendo over the past year have been games that have been out for more than two years. You think about Breadth of the Wild, Mario Kart 8, yes. These are games that they’re still pricing at full price and still getting people to come barreling in the door to buy them.

I think the key to those charts just show is ricing power.

Todd Wenning

There’s something special about that. If you look at other games, they’ll get– look at some of the hit games that came out over the past year, the spike in popularity, they get played on Twitch, and all of a sudden, they fade away, and then, they get discounted because that’s the only way they’re going to move units, do value investors, value buyers, going, “Oh, this is on sale, I’m going to buy some.”

I think that just shows you how Nintendo’s IP is differentiated. It’s timeless, it’s consistent. It’d be crazy for Nintendo to actively discount in their IP years after they sell because it’s showing that– there’s evidence that consumers keep coming back at the original price point and don’t care. I think there’s– they’d started discounting, it dilutes the IP, I think. I think it’s really important for them to hold the price. The shareholder, I’m fine with that. I love pricing power. It’s like Buffett’s quote about, if they have a prayer session before you raise prices, you don’t have a great business. Nintendo could raise prices if they want it to, and people will still buy it.

[01:22:04] Ryan O’Connor: I think they will actually. What is the new term, quadruple A games. It’s amazing to me that they haven’t….I remember video Nintendo NES games for $60, $50, $60 when we were kids. The fact that it remains that price, I think, speaks to the untapped pricing power across the gaming industry in general. I actually think that’s another shift you’re seeing is that – they haven’t raised prices in 30 years despite the cost of games, all of the inputs that go into making them go up quite a bit. I think you’re going to see a lot of pure margins, incremental revenue starts to drop to the bottom line as Nintendo follows the lead of the industry standard. I have my own thoughts. Did you have anything that you wanted to finish on?

I remember video Nintendo NES games for $60, $50, $60 when we were kids. The fact that it remains that price, I think, speaks to the untapped pricing power across the gaming industry in general.

I remember video Nintendo NES games for $60, $50, $60 when we were kids. The fact that it remains that price, I think, speaks to the untapped pricing power across the gaming industry in general.

Ryan O’Connor

[01:23:06] Tilman Versch: Todd.

[01:23:08] Todd Wenning: I just wanted to briefly add, I think this is a really important point, is that because Nintendo’s first-party games are exclusive, you have to buy the console in order to then spend $60 to get the game. It’s like if I was going to play another game, I know the system unless console – it might come more console agnostic, but if I only want to buy or only want to play Zelda, there are people who do this, who say, “I only wanted to play Zelda, so I bought a Switch and then bought the Zelda to play.”

[01:23:43] Ryan O’Connor: The only reason I bought it. That thought you’d fall in love with the magic of Breath of the Wild, which had actually got me back into gaming and really immersed into – I don’t think if I would have done that, all of the six months of intensive diligence that was kick-started from that would have happened, but anyhow.

[01:24:07] Tilman Versch: Good return on investment.

[01:24:10] Ryan O’Connor: Yes. I’d add to this point, outside of just the refusal to discounts and the perpetual evergreen nature of their software, I think it’s incredible to me where – the only real analog and video games I would say is EA sports franchises where they can come out with a new Madden and a new FIFA year over a year, like clockwork, you’re going to have an embedded base of people, but the tale of these franchises is basically perpetual. I think that is what fundamentally, and I think Nintendo also has a big, where EA and Madden, or NHL Hockey, for example, maybe you can see small incremental improvements year over year, but fundamentally in terms of gameplay and all this stuff, it’s the same game. Well, Nintendo has that with all of its core franchises. I think what makes it unique and special is that they don’t rest on their laurels and reflexively repeat the gameplay formula, the same experience with each new in the past with console generations. They totally reinvent and grow. They’re always trying to one-up themselves. I think in all of the salient matters that come to making great games.

They totally reinvent and grow. They’re always trying to one-up themselves. I think in all of the salient matters that come to making great games.

Ryan O’Connor

I think what makes it unique and special is that they don’t rest on their laurels and reflexively repeat the gameplay formula, the same experience with each new in the past with console generations. They totally reinvent and grow. They’re always trying to one-up themselves. I think in all of the salient matters that come to making great games

You can see this with Breath of the Wild or Mario Odyssey. These aren’t just copying of what has come before. They’re complete reinventions. You have this magic money machine where every time a new Mario comes out, a new Zelda comes out, maybe a new Donkey comes or I can go down the list, new Animal Crossing, a new Fire Emblem, people are going to buy it instinctually no matter what. I think the size of the fan base and the brand and its value in consumers’ eyes only grows because these games are, in many ways, works of art. I don’t know how to explain it.

I don’t know, Todd, if you ever got to Luigi’s Mansion or things like that, but the software lineup, especially in this generation, just has blown my mind in terms of how creative and original and unique these games are. You have this best of both worlds thing where you not only have an evergreen library of timeless IP that can be monetized again and again and again in various ways and formats. Think how many Mario titles there are. The creative geniuses at Nintendo find ways to make these experiences new and delightful again in ways that you’ve never experienced. I think that is a tremendously powerful element. Back to John’s point where he talks about Breath of the Wild came out four years ago. All of these core titles, as the average installed base grows, everyone wants to have them. It’s not like when you have a PS5. If you have a PS4 and a Madden, it’s not like you have to go buy the new Madden on PS5 versus PS4 if it’s the same game. With the Switch and with Nintendo, all of these titles truly are evergreen. As more and more people buy Switches and the core evergreen title expand, I think that has implications with respect to the tie ratio.

Every new customer that buys a Switch is likely over their lifetime going to buy the majority of these core evergreen franchises that continue to sell.

Ryan O’Connor

Every new customer that buys a Switch is likely over their lifetime going to buy the majority of these core evergreen franchises that continue to sell. I think all of these games that came out in terms of year one of the Switch’s continuing to crush and sell millions of copies four years later. That is radically unique in the video game industry.

Is the Switch profitable?

[01:28:51] Tilman Versch: One question still open, and maybe you could just drop a short answer. Does Nintendo earn money in the Switch, and how much in your eyes? Is it loss-making to sell Switches?

[01:29:04] Ryan O’Connor: We don’t know, but I believe it is profitable. Given the nature, you have the innovation and cost curve element of the mobile ecosystem. Parts continuously get cheaper and cheaper. In the beginning, if they certainly weren’t loss leaders, they were profitable in themselves. The magnitude of each margin on every hardware unit sold will only grow in time as the components, the cost of creating them drop rapidly. There are various ways that Nintendo can pass on that or reinvest it in better things or drop the price point to expand the user base. It’s like Apple. I don’t think they rip people’s eyes out as Apple does in terms of their hardware margins, but I think they’re solidly profitable and the profitability should continually increase over time, as the cost to create the hardware drops because the costs of the chips and all the rest are driven by a much larger global ecosystem that will guarantee it.

That’s part of the genius, the transition to primarily off-the-shelf parts. It’s not only the fact that you can incrementally, iteratively improve, and strengthen making a more efficient, faster chip for the Pros and what was in the original one to make the experience and gameplay better. You also have this fact that the profitability of the hardware units scales and expands at a much faster rate than it would if you had a highly technical customized chip, like past console generations.

[01:31:10] Tilman Versch: Do you have something to add, Todd?

[01:31:13] Todd Wenning: No. I think if anything, we would like them to have the hardware be a loss leader, right? We want to have more people in the system and then get the sales coming through at the higher margins for that software present than trying to make 20%, 30% gross profit or so on the hardware. We prefer that they just broke even on that, sold more units, and got more people in the door. I think that’s what people want me.

We prefer that they just broke even on that, sold more units, and got more people in the door. I think that’s what people want me.

Todd Wenning

I think the ultimate value of Nintendo is going to be how many people want to play its IP and whether they’re willing to pay for it. I think that’s what people are saying, “Well, they should be doing mobile.” I would argue. They should just make Switch ubiquitous, to the extent that they can and do so. Financially, it makes sense. I would prefer that.

[01:32:06] Ryan O’Connor: Yes. I think that’s part of the Apple model. One of the things I think with the Pro, you’re going to have a good-better-best pricing lineup, where you might see the Lite drop to 150, the original Switch go from 200 to 250, probably closer to 250, and then have the Pro go for 350 or something like that. Then as time goes on, you will be able to – I mean, what do they have? Like $300, $400 iPhones now with different components.